In a world the place monetary stability is usually seen as a distant dream, the attract of passive income has emerged as a beacon of hope for many aspiring wealth-builders. Imagine incomes cash whilst you sleep, journey, or pursue your passions—that is the promise that passive income holds. As the normal nine-to-five grind offers option to extra modern approaches to incomes, people are more and more turning in direction of strategies that supply the potential for monetary freedom with out the shackles of fixed labor. In this text, we’ll discover the top strategies for building wealth through passive income, diving into the various avenues accessible and uncovering the secrets and techniques that may remodel your monetary panorama. Whether you’re a seasoned investor or a curious novice, these insights will information you on a journey to not simply earn extra, however to do so in a manner that lets you take pleasure in life’s larger pleasures.Let’s delve into the world of passive income and unlock the pathways to your wealth-building potential.

Building a stable Foundation with Dividend Stocks

Dividend shares symbolize a strategic pathway to safe passive income whereas concurrently cultivating long-term wealth. These investments provide a twin profit: the potential for capital recognition and common money movement through dividend funds. To set up a powerful base, think about focusing on firms with a constant historical past of dividend development. This not solely showcases their monetary stability but in addition signifies a administration group dedicated to returning worth to shareholders. Investing in diversified sectors can cushion in opposition to market volatility, permitting you to profit from a wide range of income sources.

When deciding on dividend shares, prioritize these key components:

- Yield vs. Growth: High yield could appear enticing, however guarantee the expansion fee of dividends aligns together with your targets.

- Payout Ratio: A decrease ratio can point out sustainability, as it reveals that the firm will not be overextending itself.

- Market Position: Established firms in aggressive industries are sometimes extra dependable dividend payers.

Analyzing historic efficiency can present insights right into a inventory’s future potential. Consider structuring your investments right into a diversified portfolio, making use of the next desk to take care of focus:

| Criteria | Considerations |

|---|---|

| Dividend Yield | Look for a yield over 3% |

| 5-Year Dividend Growth | Check for constant development year-over-year |

| Payout Ratio | Aim for under 60% |

Harnessing the Power of Real Estate Investments

Investing in actual property gives an unparalleled prospect to domesticate wealth through passive income. With the proper strategies, people can leverage property values and rental income to create a sustainable monetary future. **Diversification** is vital; think about exploring varied varieties of actual property investments, equivalent to residential properties, industrial buildings, and even REITs (actual Estate Investment Trusts). Each class can present distinctive advantages and dangers, permitting buyers to steadiness their portfolios successfully. Additionally, utilizing **leverage**—financing a portion of your funding—can amplify returns, making it doable to manage bigger property with much less preliminary capital.

Another essential factor is **property administration**. Efficient administration ensures regular money movement and minimizes vacancies, which is important for sustaining a dependable passive income stream. Investors can select between self-management or hiring property administration firms. It’s additionally sensible to remain knowledgeable about **market tendencies** and native laws, as these components can considerably impression property values and rental charges. The following desk outlines the professionals and cons of various property administration approaches:

| Management Approach | Pros | Cons |

|---|---|---|

| Self-Management | Cost Savings | Time-Consuming |

| property Management Company | Expertise and effectivity | Higher Costs |

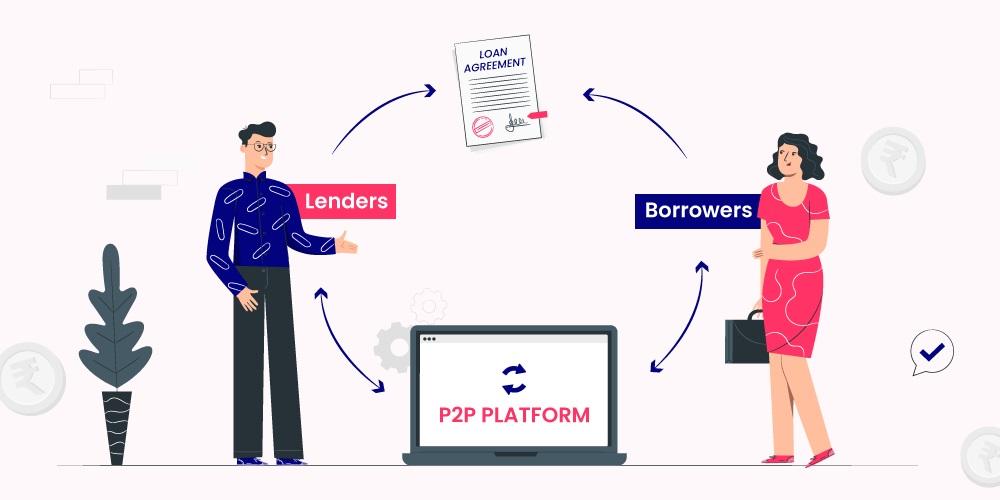

Exploring the World of Peer-to-Peer Lending

Peer-to-peer lending has emerged as an modern option to earn passive income by connecting particular person lenders instantly with debtors. by reducing out conventional monetary establishments, this mannequin permits buyers to decide on loans that align with their danger tolerance and anticipated returns. With platforms like LendingMembership and Prosper, people can diversify their portfolios by funding varied loans, thereby lowering the impression of potential defaults. Some key components to think about when taking part in peer-to-peer lending embrace:

- Credit Ratings: Assess the borrower’s creditworthiness to gauge danger.

- Loan Purpose: Understand why the borrower wants funds, as this will impression compensation chance.

- Investment Amounts: Start with small quantities to check the waters and decrease danger.

With returns incessantly sufficient surpassing conventional financial savings accounts or CDs, savvy buyers can use peer-to-peer lending as a cornerstone for their passive income technique. To maximize your potential positive factors,think about building a well-rounded lending portfolio that features varied mortgage grades and maturity lengths. This technique not solely helps mitigate danger however additionally lets you harness the ability of compound curiosity over time. Here’s a concise comparability of frequent funding choices for reference:

| Investment Type | Average Return | Risk Level | Liquidity |

|---|---|---|---|

| Peer-to-Peer Lending | 6-10% | medium | Low |

| Real Estate Crowdfunding | 8-12% | Medium-High | Medium |

| High-Yield Savings Accounts | 0.5-2% | Low | High |

| Stock Market | 7-15% | High | High |

Creating sustainable Income through Digital Products

The digital panorama gives an array of alternatives for producing passive income through varied varieties of merchandise. By leveraging your abilities and creativity,you possibly can create objects that constantly generate income with out requiring fixed effort. Consider the next avenues to discover:

- E-books: Share your experience or storytelling talents through self-published digital books.

- on-line Courses: Design structured studying experiences for others to accumulate new abilities.

- Printable Resources: Create templates, planners, or worksheets that customers should purchase and print.

- inventory Photography: promote your images on-line, permitting prospects to buy rights for use in varied initiatives.

- Membership Sites: Offer unique content material or neighborhood entry for a recurring price.

When it involves organising your digital merchandise,give attention to making a well-structured strategy that scales your efforts over time. Utilize platforms like Etsy, Udemy, or your individual web site to distribute these merchandise successfully. Here’s a easy overview of parts to think about for every kind of digital product:

| Product Type | Key Considerations | Potential Earnings |

|---|---|---|

| E-books | Editing, Cover Design | $$ – $$$ |

| Online Courses | Video Production, Marketing | $$$ – $$$$ |

| Printable Resources | design, Trends | $ – $$ |

| Stock Photography | Quality, Niche markets | $ - $$$ |

| Membership Sites | Content Updates, Community Engagement | $$$ |

Q&A

**Q&A: Top Strategies for Building Wealth Through Passive Income**

**Q1: what’s passive income, and why is it an essential a part of wealth building?**

**A1:** Passive income refers to earnings derived from rental properties, restricted partnerships, or different enterprises by which an individual will not be actively concerned. It is certainly essential for wealth building because it permits people to generate cash persistently with out consistently buying and selling their time for {dollars}. This monetary stream can facilitate freedom, cut back dependence on a single income supply, and finally increase one’s wealth portfolio.

**Q2: What are some well-liked avenues for producing passive income?**

**A2:** There are quite a few channels to discover when looking for passive income, together with:

– **Real Estate Investments:** Purchasing rental properties can yield month-to-month lease, whereas property appreciation contributes to long-term fairness.

– **Dividend Stocks:** Investing in dividend-paying shares can present common money funds as firms share their earnings with shareholders.

– **peer-to-Peer Lending:** Engaging in peer-to-peer lending platforms lets you finance loans for people or companies whereas incomes curiosity.

– **Creating Digital Products:** E-books, on-line programs, and inventory images can generate income after the preliminary effort of creation.

– **Index Funds and ETFs:** these funds permit you to make investments in a various vary of shares or bonds with minimal administration whereas reaping the advantages of compound curiosity.

**Q3: How can one begin investing in actual property for passive income?**

**A3:** Starting in actual property includes a number of steps:

1. **Educate Yourself:** perceive the market dynamics, property varieties, and funding strategies.

2. **Build Your Capital:** Save up for a down fee or discover financing choices to buy your first property.

3. **Establish a Network:** Connect with actual property brokers, buyers, and property managers who can information you.

4. **Choose the Right Property:** Focus on properties in high-demand areas that may entice tenants and pay consideration to potential upkeep prices.

5. **Consider REITs:** If direct possession appears daunting, Real Estate Investment Trusts (REITs) permit you to put money into portfolios of properties for passive income with out the trouble of administration.

**This fall: What function do digital merchandise play in passive income, and the way can one create them?**

**A4:** digital merchandise are versatile instruments for passive income as they require upfront effort however can generate income with minimal ongoing work. To create digital merchandise, you possibly can:

1. **Identify Niche subjects:** Focus on topics you might be keen about or have experience in.

2. **Create Quality Content:** Develop e-books, on-line programs, or different digital content material that gives worth to potential prospects.

3. **Utilize platforms for Launch:** Platforms like Udemy, Teachable, or Amazon Kindle permit you to attain a bigger viewers simply.

4. **Market Your Products:** Leverage social media and e-mail advertising to advertise your choices and seize an ongoing buyer base.

**Q5: What are some pitfalls to keep away from when looking for passive income?**

**A5:** While passive income generally is a profitable objective, there are potential pitfalls to be careful for:

– **Underestimating Active Involvement:** passive doesn’t imply fully hands-off. Assess your willingness to handle your investments or merchandise.

- **Lack of Research:** Ensure you completely perceive the market or area of interest to keep away from expensive errors or poor investments.

– **Ignoring Maintenance:** Properties, digital merchandise, or companies could require periodic updates or help. plan for this ongoing involvement.- **Over-diversification:** While diversification can cut back danger, spreading too skinny can dilute your focus. It’s higher to excel in just a few areas than to be mediocre in many.**Q6: How lengthy does it sometimes take to see returns from passive income investments?**

**A6:** The timeline can range considerably based mostly on the sort of funding:

– **Real Estate:** Returns could take a number of months to years, primarily relying on rental agreements and property appreciation.

– **Stocks and Funds:** Dividends from shares would possibly begin inside a quarter; nevertheless,capital positive factors usually require years.

– **Digital Products:** Income from gross sales can range however sometimes grows over time as advertising efforts acquire traction and repute builds.**Q7: Can anybody realistically obtain a passive income way of life?**

**A7:** Yes, attaining a passive income way of life is real looking for most peopel, but it surely takes dedication, strategic planning, and endurance. Start small, stay constant in your efforts, and be keen to study from successes and failures. Gradually, as your passive income streams develop, you possibly can take pleasure in the advantages of monetary independence and adaptability.

To Wrap It Up

As we conclude our exploration of the top strategies for building wealth through passive income, it’s clear that the journey to monetary freedom is each an artwork and a science. Each technique, whether or not it’s investing in actual property, creating a diversified portfolio, or creating digital merchandise, requires cautious thought, planning, and a willingness to adapt. Remember, building passive income will not be about quick riches however about sustainable development and leveraging your sources successfully.

As you embark by yourself wealth-building journey, remember the foundational rules of diligence, endurance, and continuous studying. The street could also be lengthy, however with persistence and the proper strategies, the rewards may be profound. Wherever you might be in your monetary journey, take the information you’ve gained right here and remodel it into motion.Building a way forward for monetary independence is inside your attain—so take that first step right now. Happy investing!