In right this moment’s fast-paced digital world, managing private funds can ceaselessly sufficient really feel like a frightening activity. With bills piling up, budgets stretching skinny, and financial savings accounts left wanting, many are left looking out for a guiding mild of their monetary journey. Enter private finance apps—progressive instruments designed too empower customers to take management of their cash, streamline their budgets, and in the end, increase their financial savings.Whether you are a seasoned saver or simply beginning in your monetary journey, this text explores a number of the prime private finance apps out there right this moment, every providing distinctive options to provide help to profit from your hard-earned cash. Let’s dive in and uncover the digital allies prepared to rework your monetary habits and assist you obtain your financial savings objectives.

Exploring Features That Drive Savings in Personal Finance Apps

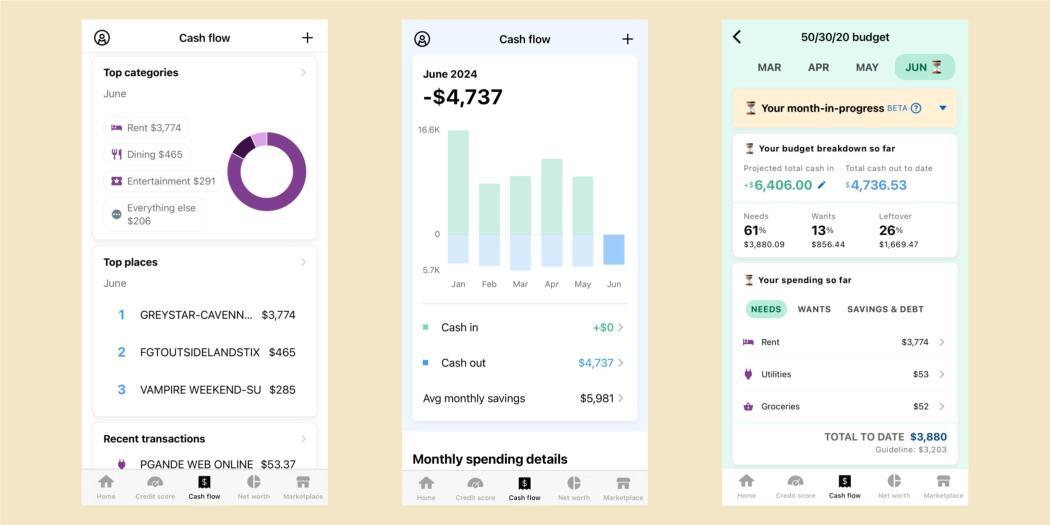

When venturing into the realm of private finance apps, a number of standout options can significantly improve your financial savings. One important side is the **automated budgeting instruments** that analyze your spending patterns and allocate funds accordingly.These instruments assist customers set lifelike monetary objectives, whereas guaranteeing that they are usually not overspending. Additionally, **round-up financial savings options** permit customers to save spare change from each day transactions, effortlessly constructing up an everyday financial savings fund over time. This gamified method not solely makes saving gratifying however additionally instills good monetary habits with out requiring drastic life-style modifications.

Another pivotal function present in many private finance apps is the **financial savings challenges** choice, which inspires customers to take part in partaking duties to attain their financial savings objectives. For instance, the appliance would possibly immediate customers to save a greenback extra every week or set apart funds based mostly on their spending habits. Furthermore, apps that provide **monetary insights** and alerts present well timed solutions for decreasing pointless expenditures, guaranteeing customers keep management over their funds. By leveraging these progressive options, customers can domesticate a disciplined method to saving and rework their monetary wellbeing.

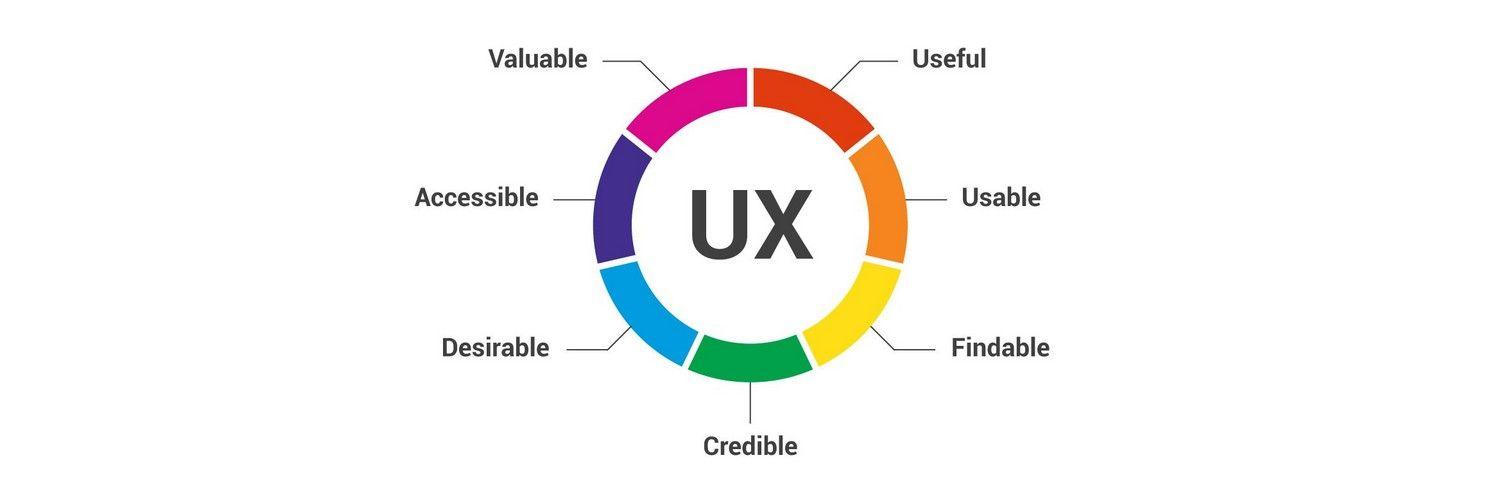

Comparing User Experiences and Ease of Navigation

When it comes to private finance apps, consumer expertise performs a pivotal position in guaranteeing customers keep engaged and motivated on their money-saving journeys. Many apps excel in offering a seamless interface that permits customers to rapidly grasp key functionalities. Generally, the very best instruments function intuitive design parts, equivalent to:

- Clear Dashboards: Users can immediately view their monetary standing, with graphical representations that simplify information interpretation.

- Customizable Features: Versatility to tailor notifications and settings to swimsuit particular person preferences enhances private relevance.

- Helpful Tutorials: Onboarding processes that information new customers can considerably ease the transition into utilizing the app.

In phrases of navigation, simplicity is essential. Users usually admire apps that prioritize easy paths to essential options. Elements like:

- Easy Menu Structures: A well-organized menu permits customers to rapidly discover budgeting instruments, expenditure monitoring, and financial savings objectives.

- Search Functions: Instant entry to assist or particular options can cut back frustration and save time.

- Responsive Design: Mobile-kind layouts allow customers to handle their funds anytime and anyplace successfully.

To visualize the variations in consumer experiences amongst prime apps, think about the next comparability:

| App identify | User Experience Rating | Navigation Ease |

|---|---|---|

| App A | 4.8/5 | Excellent |

| App B | 4.5/5 | Good |

| App C | 4.2/5 | Satisfactory |

Maximizing Savings: Tips for Leveraging App Tools and Strategies

to really capitalize on the potential of private finance apps, customers ought to undertake a strategic method that maximizes each performance and financial savings. Start by **setting clear monetary objectives** inside your chosen app, whether or not it’s budgeting for a trip or saving for a new dwelling. Many apps permit you to create a number of financial savings objectives, visually monitoring your progress with partaking charts and notifications that preserve you motivated.Additionally, allow alerts for spending habits or budgetary limits; these options can forestall overspending and encourage aware buying. As an added bonus, usually reviewing your app’s efficiency analytics can spotlight spending developments, permitting for extra knowledgeable monetary choices.

Furthermore, exploring the combination of cash-back and rewards applications inside private finance apps can considerably amplify your financial savings. Many purposes accomplice with retailers and supply **unique reductions** or **cash-back** alternatives that may be seamlessly integrated into your common buying routine. Consider using expense monitoring options that categorize your spending, which not solely simplifies budgeting but in addition reveals areas the place you can lower prices. By linking your financial institution accounts and bank cards, many apps present a complete overview of your funds, permitting you to capitalize on **financial savings instruments** like recurring transfers or automated financial savings plans. This strategic synergy between functionalities could make your financial savings journey each fruitful and easy.

Integrating Personal Finance Apps into Your Daily Routine for Optimal Results

Incorporating private finance apps into your each day routine can rework your method to managing cash, making it a seamless a part of your life. To get began,think about allocating a selected time every day to evaluation your monetary progress—maybe throughout your morning espresso or as half of your night wind-down. Visualizing your spending by means of budgeting instruments not solely retains you knowledgeable but in addition helps you establish patterns. Set up notifications to remind you of upcoming payments or to alert you when you method your funds limits, guaranteeing your monetary objectives stay on the forefront of your each day actions.

Additionally, integrating options like expense monitoring may also help keep a transparent overview of your spending habits. Utilize the next ideas to improve your expertise:

- Sync Accounts: Link your financial institution accounts to automate information entry and get real-time updates in your funds.

- Set Savings Goals: Clearly outline your monetary targets inside the app to encourage your self and monitor progress.

- Regularly Analyze Reports: Review weekly or month-to-month stories to establish areas for enchancment and have fun your achievements.

| Feature | Benefit |

|---|---|

| Automated Alerts | Stay knowledgeable of spending and financial savings. |

| Customizable Budgets | Align with your particular monetary objectives. |

| Visual Dashboards | Easily monitor monetary progress at a look. |

Q&A

**Q&A: Top Personal Finance Apps to Help You Save Money**

**Q: Why ought to I think about using a private finance app?**

A: Personal finance apps consolidate your monetary actions into one handy platform, making budgeting, monitoring bills, and saving simpler than ever. Think of them as your monetary compass, guiding you towards smarter spending choices and serving to you attain your financial savings objectives.

—

**Q: What options ought to I search for in a private finance app?**

A: Look for options that suit your life-style! Essential instruments embrace funds monitoring,expense categorization,invoice reminders,financial savings objectives,and funding monitoring. Also,think about whether or not the app integrates along with your financial institution accounts for seamless information syncing and provides sturdy security measures to preserve your monetary data secure.

—

**Q: Are these apps appropriate for all forms of customers?**

A: Absolutely! Whether you’re a seasoned monetary guru or a beginner attempting to get your funds on monitor, there are apps designed for each degree. Some apps are easy and user-friendly, very best for minimalists; others are full of superior options that enchantment to funding fans.

—

**Q: Can these apps actually assist me lower your expenses?**

A: Yes, they will! By offering insights into your spending habits and providing instruments to set and monitor financial savings objectives, private finance apps empower you to make knowledgeable choices. Over time, even small changes can lead to important financial savings. Think of these apps as your monetary accountability companions.

—

**Q: how do private finance apps preserve my data safe?**

A: Reputable private finance apps prioritize safety. Most make the most of bank-level encryption, two-factor authentication, and safe information storage practices. Research the app’s privateness coverage and security measures to make sure you’re snug with how your information will probably be dealt with.

—

**Q: Are there any free private finance apps value contemplating?**

A: Yes! Many high-quality private finance apps are free or supply freemium fashions. Apps like mint and Personal Capital present sturdy options without charge, whereas others would possibly cost for premium options. Just keep in mind to assess the app’s choices to see if the free model meets your wants.

—

**Q: How do I select the proper app for my monetary state of affairs?**

A: Start by figuring out your particular monetary objectives. Are you aiming to save for a trip, pay down debt, or make investments for retirement? Once you realize your targets, you’ll be able to discover apps tailor-made to meet these wants. Reading opinions and evaluating options may even provide help to discover the right match.

—

**Q: Can I exploit a couple of private finance app at a time?**

A: Definitely! Many customers discover it useful to use a number of apps for various functions,like one for budgeting and one other for funding monitoring. Just remember the fact that too many apps can develop into overwhelming, so select these that complement one another and provide help to keep organized.

—

**Q: How can I guarantee I stay engaged with the app over time?**

A: To keep motivated, set common check-in days to evaluation your monetary progress and replace your objectives. Some apps supply gamified experiences or rewards for attaining milestones,which may add a component of enjoyable to your saving journey. Remember, consistency is vital!

—

**Q: Do these apps present recommendations on bettering my monetary habits?**

A: Most private finance apps not solely monitor your spending but in addition supply customized recommendation based mostly in your monetary information. These ideas can be invaluable in serving to you establish areas to reduce and improve your financial savings, making your monetary wellness a bit simpler to obtain.

—

With the proper private finance app by your facet, you are well-equipped to take cost of your monetary future and watch these financial savings develop!

Key Takeaways

As we navigate the intricate panorama of private finance, the proper instruments could make all of the distinction between chaos and readability. The prime private finance apps we have explored right this moment are greater than simply digital companions; they’re highly effective allies in your quest for monetary wellness. Whether you are wanting to monitor your spending, set budgets, or scout for the very best financial savings alternatives, these apps supply options designed to empower you in your journey towards a financially safe future.Remember, the important thing to affluent cash administration is consistency and a willingness to adapt. Choose the app that resonates along with your life-style and commit to utilizing it usually. With the proper app at your fingertips, every small step you’re taking brings you nearer to your financial savings objectives. So go forward—obtain your most well-liked app and begin reworking your monetary habits right this moment. The path to smarter saving is only a click on away!