in at the moment’s fast-paced and ever-evolving panorama, younger entrepreneurs are moving into the highlight with revolutionary concepts and the willpower to make their mark. nevertheless, whereas ardour and creativity are important elements for success, thay usually discover themselves navigating the advanced world of finance—a realm that can be daunting for even probably the most seasoned enterprise leaders. As the lifeblood of any enterprise, efficient monetary administration can imply the distinction between thriving and merely surviving. In this text, we’ll discover the highest 5 monetary suggestions that each younger entrepreneur ought to embrace, offering sensible insights and simple recommendation that can assist you construct a robust basis for your corporation journey. Whether you are simply beginning out or trying to refine your monetary acumen, these methods will empower you to make knowledgeable selections and steer your entrepreneurial goals towards sustainable development.

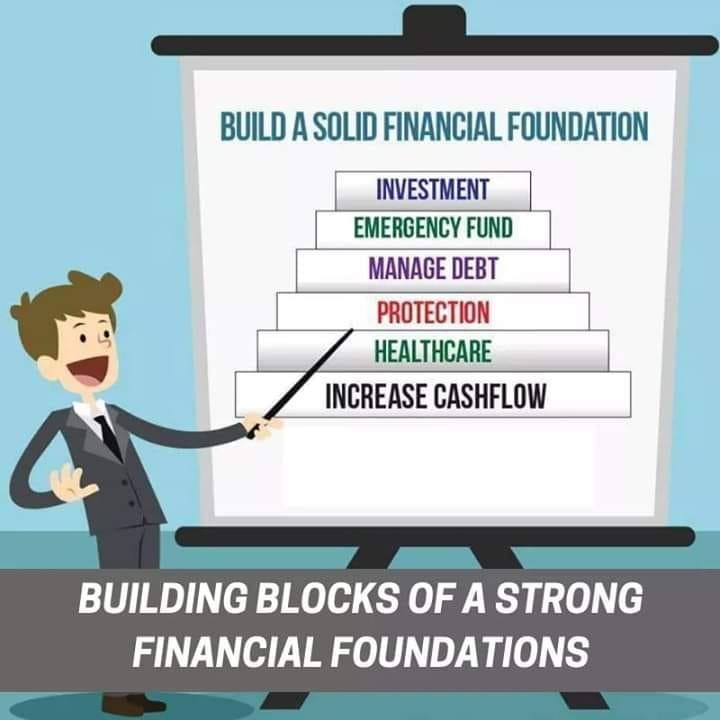

Building a Strong Financial Foundation for Your Business

Establishing a stable monetary base is important for any budding entrepreneur seeking to thrive in a aggressive habitat. Having a clear understanding of your earnings and bills can vastly affect your decision-making and future development. Start by growing a intensive finances that outlines your projected earnings, fastened and variable bills, and emergency funds. Regularly reviewing and adjusting this finances ensures that you just keep on monitor and might rapidly adapt to unexpected circumstances. It’s additionally essential to take care of meticulous information of all monetary transactions; this won’t solely show you how to preserve monitor of the place your cash goes however will additionally facilitate taxes and audits down the road.

Another important component to think about is your creditworthiness. Building a robust credit score historical past will allow you to safe loans or traces of credit score when crucial. **Establishing a enterprise bank card** and utilizing it properly can contribute significantly to enhancing your credit score rating. Additionally, take into account separating your private funds from your corporation accounts. This separation helps in precisely measuring your corporation’s monetary well being whereas additionally defending your private property. Here’s a speedy overview of some key practices:

| Key Practices | Description |

|---|---|

| Budgeting | Create and recurrently replace an in depth finances |

| Record Keeping | Maintain correct information of all transactions |

| Credit Building | Establish and use a enterprise bank card |

| Account Separation | Keep private and enterprise funds separate |

Navigating Budgeting Basics to Maximize Cash Flow

Understanding the basics of budgeting is important for any younger entrepreneur aiming to boost their money circulation. A well-structured finances acts as a monetary blueprint, guiding selections and highlighting areas for potential financial savings. Start by capturing all **earnings streams** and variable bills, together with provides, advertising, and operational prices.By categorizing your bills into **fastened** and **variable**, you’ll rapidly determine the place changes can be made with out sacrificing important features. It’s essential to set practical income targets and frequently regulate your finances in response to real-world efficiency,guaranteeing your monetary plan stays attentive to market adjustments.

Another efficient technique to spice up money circulation is implementing the 50/30/20 rule, a easy budgeting guideline that allocates your earnings as follows: **50%** for wants, **30%** for desires, and **20%** for financial savings and debt compensation. This strategy permits for versatility whereas guaranteeing that you will not be neglecting your future monetary well being. To visualize this, think about using a simple desk that summarizes your budgeting classes:

| Category | Percentage | Purpose |

|---|---|---|

| Needs | 50% | Essentials like lease, utilities, and groceries |

| desires | 30% | Non-essentials akin to eating out and leisure |

| Savings/Debt Repayment | 20% | Emergency funds and mortgage compensation |

Mastering Investment methods for Future development

In the colourful world of entrepreneurship, cultivating the correct funding mindset is essential for securing a affluent future.Young entrepreneurs ought to concentrate on constructing a sturdy funding portfolio that aligns with their long-term imaginative and prescient. Strategies akin to **diversifying property**, **reinvesting income**, and **setting apart emergency funds** are important to resist market fluctuations and capitalize on development alternatives. By in search of out funding autos that resonate with their targets, younger enterprise house owners can foster monetary resilience and stability.

It’s equally critically necessary to remain knowledgeable about rising traits and applied sciences that may improve funding selections. Engaging with business networks and academic sources can present invaluable insights into market dynamics. Consider these efficient ways:

- Regularly attending finance seminars and workshops

- Utilizing monetary planning apps for real-time insights

- Joining on-line boards with like-minded entrepreneurs

By adopting a proactive strategy to studying and networking, entrepreneurs can place themselves to make knowledgeable funding selections that propel their ventures into the longer term.

Understanding the Importance of Financial Literacy and Planning

Financial literacy types the spine of any achieved entrepreneurial enterprise. It equips younger enterprise house owners with the important expertise wanted to make knowledgeable selections about investments, budgeting, and money circulation administration. With a clear understanding of monetary ideas, entrepreneurs can higher assess dangers and alternatives, guaranteeing they allocate sources properly. This data can foster a proactive strategy to monetary planning, permitting them to set practical targets and create actionable methods.As they develop their companies, a robust monetary basis will allow them to adapt to altering market situations and navigate challenges with confidence.

Strategic monetary planning additionally performs an important position in sustaining development and maximizing income. Entrepreneurs should not solely monitor their earnings but additionally perceive their bills and create a complete finances that prioritizes important expenditures. This course of can be streamlined by utilizing instruments that facilitate monetary monitoring and evaluation. Moreover, sustaining readability about money circulation and dealing capital can assist in figuring out potential shortfalls earlier than they develop into vital points. By embracing these monetary finest practices, younger entrepreneurs can pave the way in which for long-term success and resilience in a aggressive panorama.

Q&A

**Q&A: Top 5 Financial Tips for Young Entrepreneurs**

—

**Q1: Why is it necessary for younger entrepreneurs to concentrate on monetary literacy?**

**A1:** Financial literacy is essential for younger entrepreneurs becuase it lays the groundwork for sound decision-making.understanding money circulation, budgeting, and monetary planning helps entrepreneurs navigate the challenges of operating a enterprise and positions them for long-term success. A powerful monetary basis can forestall expensive errors and allows them to grab development alternatives.

—

**Q2: What is the primary monetary tip for younger entrepreneurs?**

**A2:** The first tip is to create an in depth finances. Knowing how a lot cash is coming in and going out can illuminate spending patterns and spotlight areas for betterment. A finances acts as a roadmap, serving to entrepreneurs allocate funds strategically towards bills, financial savings, and funding with out falling into the entice of overspending.

—

**Q3: How does constructing an emergency fund profit younger entrepreneurs?**

**A3:** An emergency fund serves as a monetary security internet. For younger entrepreneurs, constructing a buffer can cushion in opposition to unexpected challenges like financial downturns, tools failures, or surprising bills. Ideally, this fund ought to cowl no less than three to six months’ price of working prices, offering peace of thoughts so entrepreneurs can concentrate on rising their enterprise, fairly of continually worrying about money circulation.

—

**This autumn: What position does networking play in monetary development for a younger entrepreneur?**

**A4:** Networking is invaluable for monetary development because it opens doorways to mentorship, partnerships, and potential funding alternatives. Young entrepreneurs can be taught from the experiences of others, share finest practices, and probably collaborate on initiatives. Building a various community may join them with buyers or prospects,turning their aspirations into tangible outcomes.

—

**Q5: Why ought to younger entrepreneurs take into account in search of skilled monetary recommendation?**

**A5:** Seeking skilled monetary recommendation is usually a game-changer for younger entrepreneurs. Financial advisors carry experience in areas like tax planning, funding methods, and danger administration that may probably be outdoors the scope of the entrepreneur’s data. This steerage can assist them make knowledgeable selections, finally main to larger monetary stability and the potential for enterprise enlargement.

—

**Q6: What ultimate piece of recommendation would you give to younger entrepreneurs on their monetary journey?**

**A6:** Embrace a mindset of steady studying. The monetary panorama is ever-evolving, and staying knowledgeable about business traits, monetary instruments, and finest practices is important.Whether via programs, seminars, or books, investing time in private finance training will empower younger entrepreneurs to adapt, innovate, and thrive in their ventures.

Future Outlook

As we wrap up our exploration of the highest 5 monetary suggestions for younger entrepreneurs, it is clear that the journey to monetary success is paved with knowledgeable selections and strategic planning. Remember, each profitable enterprise begins with a stable basis, and understanding the intricacies of private and enterprise finance is important.Embrace these ideas,keep adaptable in a dynamic panorama,and don’t hesitate to search steerage when wanted. After all,one of the best funding you may make is in your self and your rising enterprise. As you enterprise forth, could your entrepreneurial spirit flourish, and your monetary knowledge information you towards a affluent future. Here’s to turning goals into actuality, one monetary perception at a time!