In an period the place typical finance ofen feels inflexible and impersonal, peer-to-peer lending has emerged as a charming alternative—a bridge connecting people in want of loans with on a regular basis traders searching for alternatives. Like any modern monetary answer, it comes with its personal set of benefits and drawbacks, sparking each enthusiasm and warning. As we discover the multifaceted panorama of peer-to-peer lending, we invite you to weigh the advantages of democratized finance in opposition to the potential pitfalls that accompany this fashionable borrowing and investing mannequin. Dive in with us as we unravel the intricate steadiness of threat and reward on the earth of peer-to-peer lending.

Exploring the Accessibility of Peer-to-Peer Lending Platforms

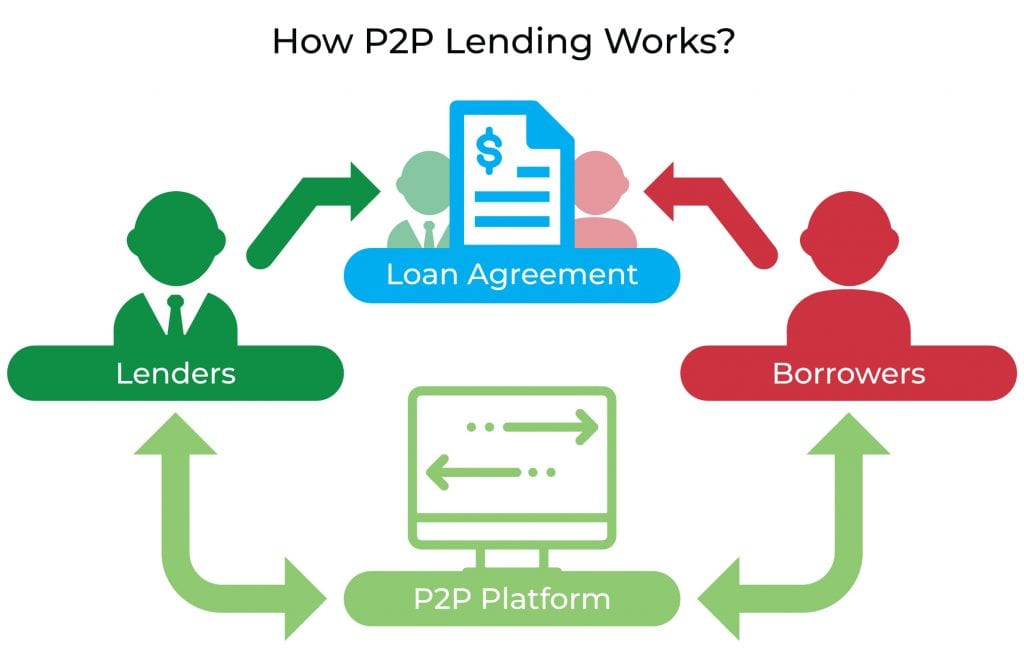

The accessibility of peer-to-peer lending platforms has revolutionized conventional financing by eliminating middlemen and enabling direct transactions between lenders and debtors. This shift has made it simpler for people to acquire loans while not having to navigate the continuously enough-overwhelming necessities set by typical banks.As a outcome,these platforms cater to varied demographics,together with these with restricted credit score histories or unconventional monetary wants.The streamlined processes and user-friendly interfaces permit debtors to shortly assess their choices and discover funding that meets their particular circumstances.

However, accessibility does include its challenges. Many debtors might not totally perceive the phrases and situations related to peer-to-peer lending, which might lead to potential pitfalls such as larger rates of interest and charges in contrast to conventional lenders. Moreover, the variability in platform laws implies that not all customers can have equal entry to assets or help. To illustrate this level, take into account the next desk evaluating key options of standard peer-to-peer lending platforms:

| Platform | Minimum Credit Score | Loan Amount Range | Interest Rates |

|---|---|---|---|

| Platform A | 600 | $1,000 – $50,000 | 5% - 30% |

| Platform B | 650 | $2,000 - $35,000 | 4% – 25% |

| Platform C | No Minimum | $500 – $15,000 | 6% – 35% |

While these platforms present alternatives for many, understanding the nuances of every choice is crucial for debtors to make sure they make knowledgeable selections and keep away from potential monetary burdens.

Weighing the Risk Factors in Peer-to-Peer Financing

Engaging in peer-to-peer financing comes with an array of threat elements that each lenders and debtors should rigorously take into account. For debtors,the absence of stringent regulatory oversight can result in unpredictable lending phrases and potential pitfalls. A couple of frequent threat elements embody:

- Credit Default Risk: The likelihood {that a} borrower might fail to repay their mortgage on time.

- Interest Rate Fluctuations: modifications in market curiosity charges can have an effect on mortgage affordability.

- Limited Transparency: Variability in borrower profiles can make it difficult for lenders to gauge threat successfully.

On the lender’s facet, the potential for monetary loss can develop into a major concern. defaulting debtors can impression returns considerably, and on many platforms, diversification is not assured.Some key threat elements embody:

- Economic Downturns: Financial crises can result in elevated defaults, adversely affecting funding efficiency.

- Platform Reliability: The trustworthiness of the peer-to-peer platform performs a significant position within the security of investments.

- Liquidity Issues: Funds lent could also be tied up for prolonged durations, limiting entry to money.

Evaluating the Financial Returns on Peer-to-Peer Investments

When diving into the world of peer-to-peer (P2P) lending, assessing monetary returns requires a nuanced understanding of each potential good points and related dangers. P2P platforms typically promise larger returns in comparison with conventional funding autos like financial savings accounts or authorities bonds. However, these engaging charges can masks underlying uncertainties.Investors ought to take into account elements corresponding to:

- Borrower default charges: The chance of debtors failing to repay their loans can considerably have an effect on returns.

- Loan grades: higher-rated loans typically current decrease dangers, albeit with decrease returns.

- Earning durations: The period for which the funding is locked can affect general acquire.

Moreover, understanding the charges related to P2P platforms is essential for an correct return analysis. Each platform operates with various price buildings, starting from servicing charges to withdrawal charges, which might erode earnings. To present an overview, take into account the next simplified comparability of potential returns:

| Platform | common Annual Return | Fees |

|---|---|---|

| Platform A | 7% | 1% servicing price |

| Platform B | 6.5% | 0.5% servicing price |

| Platform C | 8% | 1.5% servicing price |

It’s important for traders to weigh these varied metrics in opposition to their monetary targets and threat tolerance. A thorough understanding will empower debtors to make knowledgeable selections and maximize their peer-to-peer funding potential.

Navigating Regulations and Consumer Protections in Peer-to-peer Lending

Peer-to-peer lending operates inside a fancy framework of laws geared toward safeguarding each debtors and traders. As these platforms acquire traction, regulatory our bodies are stepping up their oversight to make sure transparency and truthful practices. **Key laws** impacting peer-to-peer lending embody:

- Requirements for platforms to register with monetary authorities

- Disclosure of mortgage phrases and curiosity charges

- Consumer safety legal guidelines addressing fraudulent actions and privateness

While these laws improve shopper protections, they could additionally impose extra prices on platforms, probably resulting in larger charges for customers. Furthermore, understanding native and nationwide laws can be daunting for new traders, making it important to keep knowledgeable. **Investors should be conscious of:**

- The various curiosity price caps in several areas

- threat evaluation standards used by the platforms

- Protections accessible in case of a platform’s chapter

Q&A

**Title: The Pros and Cons of peer-to-Peer Lending: A complete Q&A**

—

**Q1: What precisely is peer-to-peer lending, and how does it work?**

**A:** Peer-to-peer (P2P) lending is a monetary mannequin that connects debtors immediately with particular person lenders via on-line platforms. Rather than going via conventional banks, debtors can search loans from particular person traders, who earn curiosity on the cash they lend. It’s like a matchmaking service for cash: the platform assesses the borrower’s creditworthiness and then hyperlinks them to potential lenders who are keen to fund their mortgage.

—

**Q2: What are the important thing advantages of peer-to-peer lending for debtors?**

**A:** Borrowers can take pleasure in a number of benefits when opting for P2P lending, together with aggressive rates of interest which may be decrease than conventional loans, a streamlined utility course of, and typically sooner entry to funds.Some platforms additionally cater to debtors with less-than-perfect credit score, offering alternatives that banks might not provide.

—

**Q3: Are there benefits for lenders as nicely?**

**A:** Absolutely! Lenders within the P2P house can obtain probably larger returns in comparison with conventional financial savings accounts or fixed-income investments. They have the adaptability to decide on which loans to fund based mostly on the rates of interest, phrases, and the creditworthiness of debtors, permitting for a extra personalised funding technique.

—

**This autumn: What are some of the dangers concerned in peer-to-peer lending?**

**A:** Like any funding, P2P lending carries its dangers. Borrowers might default on their loans, main to potential losses for lenders. Unlike financial institution deposits, P2P loans are not insured, which means the threat of default could also be larger than conventional financial savings. Market fluctuations and platform reliability are extra considerations, as not all P2P platforms are created equal.

—

**Q5: How does P2P lending have an effect on the general financial system?**

**A:** P2P lending can improve monetary inclusion by offering extra people and small companies entry to funds they may or else lack. This mannequin can stimulate financial progress by facilitating private and enterprise investments. Though, the rise of P2P lending might additionally imply diminished roles for conventional banks, probably creating instability within the monetary sector if not correctly monitored.—

**Q6: What ought to potential debtors or lenders take into account earlier than collaborating in peer-to-peer lending?**

**A:** Both events ought to rigorously consider their monetary conditions and targets. Borrowers ought to perceive the phrases and rates of interest, whereas lenders ought to assess the danger and diversify their investments throughout a number of loans to mitigate potential losses. Researching the platform’s repute, regulatory compliance, and buyer suggestions is essential for a secure and useful expertise.

—

**Q7: Is peer-to-peer lending appropriate for everybody?**

**A:** While P2P lending will be useful for a lot of, it isn’t suited for everybody. Borrowers in pressing want of money would possibly discover it unhelpful because of the applying course of, and these risk-averse might draw back from investing in loans that carry the risk of default. Ultimately, thorough analysis and a transparent understanding of one’s monetary panorama are important earlier than diving into the P2P lending pool.

—

**Conclusion:** Peer-to-peer lending presents an thrilling different to conventional finance, bursting with potential for each debtors and lenders.However, like all monetary enterprise, it comes with its personal set of challenges. A diligent method will help navigate this modern panorama efficiently.

In Summary

peer-to-peer lending stands as a partaking monetary innovation that redefines the standard lending panorama. By connecting people immediately, it gives a distinctive platform the place debtors might discover extra accessible credit score choices, and traders acquire the potential for engaging returns. However, as with any monetary enterprise, it’s vital to tread rigorously. The dangers – from potential defaults to regulatory uncertainties – are noteworthy and shouldn’t be neglected.

As you weigh the professionals and cons, keep in mind that understanding the intricacies of peer-to-peer lending can empower you to make knowledgeable selections tailor-made to your monetary targets. Whether you are looking for to diversify your funding portfolio or in want of a mortgage, transparency and prudence will be your finest allies in this evolving market. Ultimately, as you embark on this lending journey, take into account not simply the numbers, however the tales and aspirations that lie behind each mortgage. the selection is yours – to lend or to borrow, to discover the chances or to remain the course. The world of peer-to-peer lending is at your fingertips; navigate it properly.