**The Beginner’s Guide to Understanding Financial Markets**

Welcome to the intriguing world of monetary markets, the place complicated transactions adn refined indicators give life to the financial system’s heartbeat. For many, this realm might appear daunting, stuffed with jargon and rapid-fire exchanges, however worry not! This information is tailor-made for these taking their first steps into the attention-grabbing panorama of finance. Whether you’re inquisitive about how inventory exchanges function, how bonds operate, or the underlying rules that drive these markets, you’re in the correct place. By demystifying the important ideas and offering a stable basis, we intention to equip you with the information you want to navigate these waters with confidence. Let’s embark on this academic journey collectively and unlock the potential that lies throughout the monetary markets.

Exploring the Fundamentals of Financial Markets

Financial markets are intricate techniques that facilitate the shopping for and promoting of belongings, together with shares, bonds, and commodities. Understanding these markets requires a grasp of a number of fundamental ideas. Key elements embody:

- Market individuals: Individuals and establishments that have interaction in buying and selling,together with buyers,merchants,and establishments.

- Types of markets: Various markets exist, comparable to fairness markets (shares), debt markets (bonds), and derivatives markets (choices, futures).

- Market devices: The instruments used for buying and selling,every serving distinct functions,such as equities,fixed-income securities,and derivatives.

- Market construction: The framework that dictates how buying and selling happens, together with exchanges and over-the-counter (OTC) venues.

A vital side of economic markets is the idea of liquidity, which refers to how simply belongings could be purchased or bought with out inflicting a big impression on their worth. High liquidity suggests a market through which belongings are simply tradable, whereas low liquidity might point out challenges in executing trades effectively. Additionally, market effectivity performs a significant position; it describes how rapidly and precisely costs mirror out there data. Understanding these dynamics helps buyers make knowledgeable selections. Below is a easy desk that highlights the variations between main and secondary markets:

| Primary Market | Secondary Market |

|---|---|

| Where new securities are created | Where present securities are traded |

| Participants embody issuers and preliminary buyers | Participants embody buyers shopping for and promoting amongst themselves |

| Typically includes an preliminary public providing (IPO) | Involves transactions after the IPO |

Decoding Market Mechanisms: How Transactions Work

Understanding the internal workings of monetary transactions is essential for anybody trying to navigate the complexities of the market.At its core, transactions are pushed by the legal guidelines of provide and demand, the place consumers and sellers converge to agree on a worth. The course of could be damaged down into basic elements: **order sorts**, **execution venues**, and **settlement mechanisms**. Each of those parts performs a pivotal position in figuring out the effectivity and transparency of trades, permitting individuals to specific their market views, handle dangers, and take benefit of worth actions.

When a purchaser needs to buy an asset, thay create an **order** that specifies key particulars comparable to amount and worth.This order could be executed by way of varied **venues**, which can embody typical exchanges or digital platforms. Upon reaching an settlement, the transaction strikes to the **settlement** section, guaranteeing the switch of possession and funds. Here’s a fast overview of the diffrent order sorts that one may encounter:

| Order Type | Description |

|---|---|

| Market Order | Executed instantly on the present market worth. |

| Limit order | Executed solely when the asset reaches a specified worth. |

| Stop Order | Becomes a market order when a particular worth is reached. |

This simplified view of transactions illustrates the dynamic interaction of varied market forces. Each transaction not solely displays particular person selections however additionally contributes to the broader market panorama,shaping traits and influences that have an effect on all merchants.understanding these mechanisms can empower you to make knowledgeable selections, finally enhancing your expertise within the monetary markets.

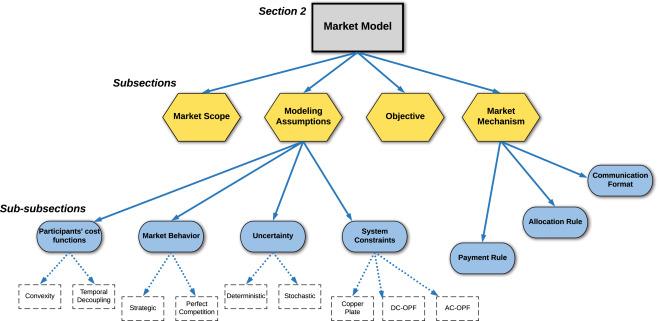

Essential Investment Vehicles for Newcomers

When diving into the monetary markets, it is very important to perceive the completely different funding automobiles out there for learners. Each possibility gives distinctive advantages and dangers, making it important to select properly. **Stocks**,for instance,symbolize possession in an organization and can present appreciable returns over time. Alternatively, **bonds** are basically loans made to governments or firms, sometimes providing decrease danger and predictable revenue.Other standard options embody **mutual funds**, which pool buyers’ cash to purchase a diversified portfolio of belongings, and **exchange-traded funds (ETFs)**, comparable to mutual funds however traded on inventory exchanges. By exploring these avenues, newcomers can discover the correct stability of danger and reward that fits their funding targets.

furthermore,aspiring buyers also needs to take into account **actual property** as a tangible asset that may respect over time and generate rental revenue.Another more and more standard selection is **index funds**, which observe particular market indices, offering a low-cost approach to make investments broadly. In addition, **cryptocurrencies** have emerged as a brand new funding class, providing doubtlessly excessive rewards however with vital volatility. Below is a short comparability of these funding automobiles:

| Investment Vehicle | Risk Level | Potential Returns |

|---|---|---|

| Stocks | High | High |

| Bonds | Low | Moderate |

| Mutual Funds | Moderate | Moderate |

| ETFs | Moderate | Moderate-High |

| Real Estate | Moderate | Variable |

| Cryptocurrencies | Very High | Very High |

| Index Funds | Moderate | Moderate |

Strategic Tips for Navigating Market Volatility

Market volatility can evoke a spread of feelings,from worry to pleasure. To successfully handle these fluctuations, it is important to undertake a strategic mindset.Start by **diversifying your portfolio**; a mixture of asset lessons—like shares, bonds, and commodities—can cushion towards unpredictable shifts. Consider **staying knowledgeable** by following monetary information, skilled analyses, and financial indicators. Establish an outlined **danger tolerance** to information your funding selections, guaranteeing that you simply’re not overexposed to any single sector or inventory.

Additionally, implement a disciplined method to buying and selling. Develop a **set of guidelines** to dictate when to purchase or promote primarily based on particular market circumstances, quite than emotional reactions. **Utilize stop-loss orders** to restrict potential losses and shield your investments throughout downturns. Monitoring **market traits** and historical information can even present invaluable insights into potential worth actions. By remaining proactive quite of reactive, you possibly can navigate by way of intervals of turbulence with larger confidence and readability.

Q&A

### Q&A: The Beginner’s Guide to understanding Financial Markets

**Q1: What are monetary markets, and why do they matter?**

**A1:** Financial markets are platforms that facilitate the trade of economic belongings like shares, bonds, currencies, and commodities. They play a essential position within the financial system by offering companies with entry to capital, enabling people to make investments and save, and aiding governments in funding public providers. Understanding these markets is important for making knowledgeable funding selections and greedy the financial forces that have an effect on our each day lives.

—

**Q2: What sorts of economic markets exist?**

**A2:** Financial markets can be broadly categorized into a number of sorts:

– **Stock Markets:** Where shares of publicly traded firms are purchased and bought.

– **Bond Markets:** Where debt securities are issued and traded, permitting entities to borrow cash.

– **Commodities Markets:** Where uncooked supplies like gold, oil, and agricultural merchandise are exchanged.

– **Foreign Exchange (Forex) Markets:** Where currencies are traded, facilitating worldwide enterprise and commerce.

– **Derivatives Markets:** Where monetary contracts whose worth is derived from underlying belongings are traded,typically used for hedging or hypothesis.

Each market serves a novel goal and operates underneath distinct guidelines.

—

**Q3: How can learners begin studying about monetary markets?**

**A3:** Beginners can begin their journey by studying introductory books and respected articles,taking on-line programs,and following monetary information. Websites, podcasts, and academic YouTube channels devoted to finance can present accessible data. Additionally,many platforms supply simulators to follow buying and selling with out monetary danger. Engaging with these sources in a structured method can construct foundational information and confidence.

—

**This autumn: What are some frequent misconceptions about investing in monetary markets?**

**A4:** One prevalent false impression is that monetary investing is barely for the rich or these with superior levels in finance. In actuality, anybody can begin investing with a modest sum and a fundamental understanding of the markets.Another fantasy is that investing is synonymous with playing; whereas each contain danger, investing is rooted in analysis and technique, focusing on long-term progress quite than mere likelihood.

—

**Q5: What position does danger play in monetary markets?**

**A5:** Risk is an inherent side of economic markets, as completely different investments carry various ranges of danger and potential return. Understanding danger tolerance—your potential and willingness to endure market fluctuations—is crucial for creating an funding technique.It’s vital for learners to notice that with larger potential returns typically comes larger danger, and balanced portfolios will help mitigate a few of that danger.

—

**Q6: How do I select the place to make investments my cash?**

**A6:** Choosing the place to make investments includes evaluating your monetary targets, danger tolerance, and funding horizon. Conducting thorough analysis on asset lessons, industries, and particular person investments can illuminate potential alternatives and threats. Diversification—spreading investments throughout completely different asset sorts—can scale back danger. Consulting a monetary advisor for customized steering can additionally present readability and path, particularly for these simply beginning out.—

**Q7: What are key indicators to watch in monetary markets?**

**A7:** Key indicators embody financial information like GDP progress charges, unemployment figures, inflation charges, and shopper confidence indices, which mirror the well being of the financial system. Additionally, monitoring market indices such because the S&P 500 or Dow Jones Industrial Average can present a snapshot of total market efficiency. Paying consideration to rates of interest and financial coverage from central banks can also be very important, as these can affect market motion considerably.

—

**Q8: How can emotional components impression investing?**

**A8:** Emotions play a big position in funding habits. Fear and greed can drive rash selections throughout market volatility, typically ensuing in shopping for excessive and promoting low. Maintaining a disciplined, well-thought-out funding technique and avoiding emotional reactions to market fluctuations are important for long-term success. Cultivating endurance and resilience can assist navigate the inevitable ups and downs of the monetary markets.

—

**Q9: What’s the long-term outlook for somebody simply beginning in monetary markets?**

**A9:** For novices in monetary markets, the long-term outlook could be fairly constructive, particularly with a dedication to steady studying, prudent danger administration, and disciplined investing. While markets will expertise ups and downs, traditionally, they’ve trended upwards over time. Staying knowledgeable, adjusting methods as wanted, and being affected person can lead to vital monetary advantages over the lengthy haul.

—

**Q10: the place can individuals discover extra sources about monetary markets?**

**A10:** A wealth of sources is out there on-line, from monetary information web sites and funding blogs to academic platforms like Coursera and Khan Academy. Books by respected authors on investing and economics can serve as glorious references as effectively. Local libraries and neighborhood faculties might supply workshops or programs on finance, and becoming a member of funding golf equipment or on-line boards can present invaluable peer help and insights.

Future Outlook

As we conclude our exploration into the intricate world of economic markets, it is important to bear in mind that information is the inspiration upon which profitable buying and selling and investing are constructed. By equipping your self with the fundamental rules outlined in this information, you are now higher positioned to navigate the ebb and move of financial tides, make knowledgeable selections, and even domesticate a way of confidence in your monetary journey.

Financial markets could seem daunting at first look, however like several complicated system, they turn into clearer with endurance and follow. whether or not you select to dabble in shares,bonds,or commodities,bear in mind that every selection carries its personal classes and potential rewards.

As you step ahead into this vibrant panorama, hold curiosity and a willingness to be taught on the forefront of your method. The monetary world is ever-evolving, and staying knowledgeable will guarantee that you simply stay adept within the artwork of funding. Embrace the journey that lies forward, and will your endeavors lead you towards monetary progress and success. Happy investing!