In the colourful panorama of entrepreneurship,securing investors usually stands because the pivotal bridge between a visionary concept and its fruition. For many startup founders, the hunt for monetary backing can really feel like navigating a labyrinth—stuffed with potential pitfalls and uncharted territories. Yet, inside this problem lies a possibility to craft compelling narratives, construct real connections, and showcase the distinctive worth of their ventures. This article delves into the methods and insights that may undoubtedly assist you to, as a budding entrepreneur, not solely appeal to investors but in addition forge lasting partnerships that propel your startup towards success. Whether you’re within the ideation part or making ready to scale,understanding the delicate artwork of securing funding is an important keystone to turning your aspirations into actuality. let’s discover the important steps to captivate investors and convey your startup goals to life.

figuring out the Right Investor Profile for Your Startup

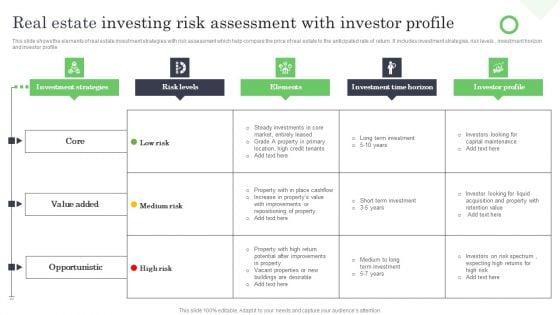

understanding the appropriate investor profile is essential for your startup’s success. Different investors carry distinctive advantages and challenges, so aligning your enterprise imaginative and prescient with their funding model can make a critically vital distinction. Here are some profiles to think about when figuring out potential investors:

- Angel Investors: Often high-net-worth people who present capital in change for fairness. Thay normally have trade experience and may supply useful mentorship.

- Venture Capitalists: Typically affiliated with corporations that handle pooled funds from numerous investors. They search startups with excessive progress potential and anticipate important returns.

- Crowdfunding: This mannequin entails elevating small quantities of cash from numerous individuals, regularly sufficient by way of on-line platforms. It permits you to gauge public curiosity and construct a buyer base.

- Corporate Investors: Established corporations that put money into startups for strategic causes, similar to gaining perception into innovation or accessing new markets.

Once you establish potential investors, it is important to consider their backgrounds to guarantee compatibility. Analyze their earlier investments, trade focus, and exit methods. You can use a easy desk to examine the important thing components:

| Investor Type | Typical Investment Size | What They Offer |

|---|---|---|

| Angel Investor | $25K – $500K | Mentorship, Networking |

| Venture Capitalist | $500K – $10M+ | Strategic Guidance, Resources |

| Crowdfunding | $10 - $1M | Market Validation, Customer Base |

| Corporate Investor | $100K – $5M | Strategic Partnerships, trade Insight |

crafting a Compelling Pitch that Captivates and Engages

To seize the curiosity of potential investors, your pitch should open with a robust narrative that resonates emotionally. **Start with a private story or an eye-opening statistic** that underscores the issue your startup goals to resolve. This not solely grabs consideration but in addition establishes why this situation issues. Next, clearly articulate your **distinctive worth proposition**; what makes your resolution totally different and higher than present choices? Ensure that your message is concise but compelling to maintain their curiosity and go away them wanting extra.

In the subsequent part of your pitch, give attention to constructing credibility and creating a way of urgency. Include **well-researched knowledge** that demonstrates market demand and potential progress. Consider the next factors when presenting your enterprise mannequin:

| Key Elements | Description |

|---|---|

| Market Analysis | A short overview of the goal market measurement and buyer demographics. |

| Revenue Model | Explain how you propose to earn a living and maintain progress. |

| Competitive Advantage | Highlight what units you aside from opponents, similar to know-how or partnerships. |

| Funding Objectives | Clearly state how a lot funding you want and what it will likely be used for. |

By infusing ardour into your pitch and backing it up with analysis, you not solely have interaction investors but in addition instill confidence in your imaginative and prescient. Ensure that you just follow your supply to keep power and enthusiasm all through the presentation, making your startup impractical to overlook.

Building Relationships: Networking Strategies for Success

Securing investors for your startup hinges considerably on the energy of your community. To construct useful connections, have interaction with trade occasions, native meetups, and entrepreneurial workshops had been you can meet like-minded people and potential investors. Focus on creating **significant interactions** quite than superficial exchanges. Share your entrepreneurial journey, hear actively, and search recommendation. Over time, these relationships can evolve into alternatives for funding. Participate in on-line boards and communities the place investors collect, and in addition social media platforms like LinkedIn to broaden your attain and visibility.

When approaching potential investors, it is important to have a stable technique. Consider the next ways:

- Elevator Pitch: Craft a concise and compelling elevator pitch that encapsulates your enterprise concept and its potential. Aim for readability and enthusiasm.

- Follow-Up: After preliminary contact, make it a behavior to comply with up. A well mannered message reiterating your curiosity in collaborating can preserve you on their radar.

- Mutual Connections: Leverage mutual connections to facilitate introductions, as referrals usually carry extra weight than chilly outreach.

Additionally, making a structured plan may be useful. Utilize a easy desk to preserve observe of your interactions:

| Investor Name | Contact Date | Notes |

|---|---|---|

| Jane Smith | 01/10/2023 | Interested in tech startups.Follow up subsequent month. |

| John Doe | 15/09/2023 | Recommended by mutual connection. Send pitch deck. |

Demonstrating Value: Key Metrics Investors Want to see

Investors are all the time on the lookout for quantifiable proof that your startup holds potential for important progress. **Key efficiency indicators (KPIs)** play an important position on this course of, as they assist show your company’s potential to successfully execute its enterprise mannequin. Some important metrics to think about showcasing embody:

- Customer Acquisition Cost (CAC): The whole price related with buying a brand new buyer, which displays your advertising and marketing effectiveness.

- Monthly Recurring Revenue (MRR): represents predictable revenue generated month-to-month, essential for subscription-based fashions.

- Churn Rate: the share of clients who discontinue their subscriptions, an indicator of buyer satisfaction and product worth.

- Burn fee: The fee at which your company spends capital earlier than producing a optimistic money circulate.

Additionally, visualizing these metrics by way of a concise desk can improve your pitch’s readability. Metrics like these not solely illustrate previous efficiency however additionally undertaking future progress potential.

| Metric | Value | Trend |

|---|---|---|

| Customer Acquisition Cost (CAC) | $150 | ↓ 10% (QoQ) |

| Monthly Recurring Revenue (MRR) | $30,000 | ↑ 15% (QoQ) |

| Churn Rate | 5% | ↓ 1% (qoq) |

| Burn Rate | $20,000 | Stable |

Q&A

### Q&A: How to Secure Investors for Your Startup Company

**Q: What’s step one I ought to take when trying for investors for my startup?**

A: The journey begins with a stable basis. Before reaching out to potential investors, refine your marketing strategy. This doc ought to clearly define your services or products, goal market, income mannequin, and progress technique.Investors need to perceive your imaginative and prescient, so ensure to incorporate knowledge and analysis that assist your claims.

—

**Q: How vital is it to create a pitch deck?**

A: A pitch deck is your startup’s visible storytelling instrument. Think of it because the brief trailer that captures the essence of your function movie. A well-designed, concise pitch deck can have interaction investors and spark discussions. goal for about 10-15 slides masking your worth proposition, market alternative, enterprise mannequin, staff, and monetary projections.Remember to preserve it clear and visually interesting!

—

**Q: Should I give attention to angel investors or enterprise capitalists?**

A: The alternative between angel investors and enterprise capitalists usually relies on your startup’s present stage and funding wants. Angel investors are usually extra hands-on and keen to fund early-stage corporations, providing mentorship alongside capital. Venture capitalists, conversely, typically look for extra established startups that may promise important returns inside a couple of years. Assess your wants and align with the appropriate sort of investor.

—

**Q: How do I discover potential investors?**

A: Start with your community—mates, household, and colleagues may know people trying to make investments. Then, broaden your attain by way of networking occasions, pitch competitions, and startup accelerator applications.Online platforms similar to AngelChecklist or LinkedIn may also be invaluable for figuring out and connecting with investors who align with your trade and imaginative and prescient.

—

**Q: What ought to I anticipate through the due diligence course of?**

A: Due diligence can really feel like an intense examination for each events. Investors will need to scrutinize your enterprise mannequin, monetary statements, authorized paperwork, and even your staff’s backgrounds. Be ready to reply robust questions and supply in depth documentation. This course of helps be sure that investors perceive the dangers concerned, so transparency and affiliation are essential.

—

**Q: How can I make a long-lasting impression throughout investor conferences?**

A: Authenticity is vital! Investors usually are not simply investing in concepts however within the individuals behind them. Convey your ardour and dedication, share your private story related to the enterprise, and be smitten by your product. Incorporate compelling narratives that spotlight your startup’s influence. A good narrative not solely informs but in addition engages on an emotional stage.

—

**Q: What position does follow-up play in securing funding?**

A: Follow-up is the place many entrepreneurs slip by way of the cracks. After conferences,ship a thank-you observe expressing gratitude for their time and reiterating key factors mentioned.This retains the traces of interplay open and demonstrates your professionalism.A well timed follow-up can preserve your startup contemporary in an investor’s thoughts, and serve as a possibility to present any further data they could have requested.

—

**Q: what if I face rejection?**

A: Rejection is a pure a part of the startup journey—think about it useful suggestions. Use it to refine your pitch, strengthen your enterprise mannequin, or discover new investor avenues. Each “no” brings you one step nearer to a “yes.” Persistence and flexibility are important traits of profitable entrepreneurs!

—

securing investors for your startup is a multifaceted course of that calls for readiness,networking,and resilience.With the appropriate method, your ardour can flip into not simply an funding, however a robust partnership that propels your enterprise ahead.

In Retrospect

In the dynamic world of startups, securing the appropriate investors can be the linchpin that propels your imaginative and prescient into actuality. As you navigate this intricate panorama, keep in mind that constructing genuine relationships and demonstrating your ardour for your enterprise are simply as essential because the numbers you current.With thorough preparation, a compelling story, and a transparent monetary path, you are not simply searching for funds; you are inviting companions into a shared journey.

As you step into these essential conferences or pitch occasions,remember that every interplay is a chance to domesticate belief and confidence in your mission.The highway to securing investors could also be stuffed with challenges and setbacks, however perseverance, adaptability, and an unwavering perception in your startup will open doorways to potentialities you by no means imagined.

With dedication and strategic insights, you’ll not solely appeal to the appropriate investors but in addition lay the basis for lasting progress and innovation. it isn’t solely about the capital you purchase however the relationships you construct that will form the way forward for your endeavor. Forge forward with braveness and readability, and will your startup flourish with the assist and knowledge it deserves.