As the horizon of 2025 approaches,many debtors discover themselves at a pivotal crossroads of their monetary journeys—notably these grappling wiht student loans. With interest rates fluctuating and monetary establishments keen to entice clients, the panorama for refinancing has by no means been extra promising. If you’re burdened by high-interest student loans, the prospect of securing a decrease charge can really feel like a golden alternative on the path to monetary freedom. In this text, we’ll discover efficient methods for refinancing your student loans at low interest rates, empowering you to take management of your debt and redefine your future. whether or not you’re a latest graduate, a seasoned skilled, or a mum or dad navigating this advanced terrain, the insights shared right here will information you in making knowledgeable selections that align with your monetary objectives. Let’s unlock the potential of 2025 collectively and pave the manner for a brighter, extra manageable monetary tomorrow.

Strategies for Identifying the Best Low Interest Rates in 2025

To safe essentially the most favorable low interest rates for refinancing student loans in 2025, it is important to conduct thorough analysis and make the most of a range of assets. Start by monitoring monetary information and developments, as world financial shifts can affect interest rates considerably.Consider utilizing on-line mortgage comparability instruments that not solely showcase lenders’ rates however additionally permit you to tailor the comparability based mostly in your credit score rating and mortgage quantity. This can lead to extra customized outcomes. Additionally, subscribing to newsletters from monetary establishments can supply insights into limited-time promotions or charge cuts that is probably not broadly marketed.

Moreover, participating with monetary advisors or using group boards targeted on student loans can present you with real-time suggestions from those that have not too long ago navigated the refinancing course of.**Employing the next methods can improve your technique**:

- **Understand your credit score rating**: Check your credit score report often to establish areas for enchancment.

- **Shop round**: Don’t accept the first charge you encounter; completely different lenders could supply vastly completely different phrases.

- **Consider federal vs. non-public choices**: Weigh the advantages of federal mortgage protections towards potential non-public lender perks.

In addition to these methods, maintaining a tally of the Federal Reserve’s selections concerning interest rates can present priceless foresight into market developments which will have an effect on your refinancing alternatives.

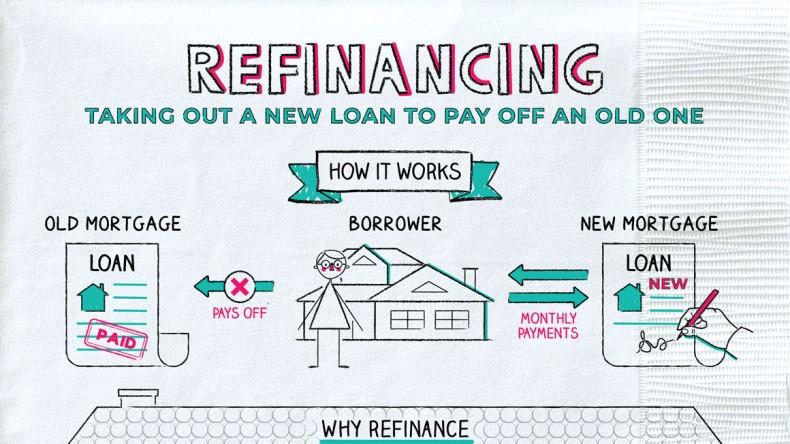

Understanding the Refinancing Process and Its Benefits

Refinancing student loans entails taking out a brand new mortgage to repay present ones, continuously sufficient leading to a decrease interest charge or extra favorable reimbursement phrases. To start the method, debtors usually assess their present monetary scenario, together with credit score scores and earnings. Understanding numerous mortgage choices is essential for selecting the right lender, which may present you with an optimum interest charge and reimbursement plan. This process not solely simplifies your monetary obligations however may also maybe lead to vital financial savings within the long run.

The advantages of refinancing are huge and may enormously influence general monetary well being. Some key benefits embody:

- Lower Monthly Payments: By securing a decrease interest charge, month-to-month funds may be decreased, easing monetary pressure.

- Flexible Terms: Refinance choices continuously sufficient embody a wide range of reimbursement phrases, permitting debtors to select a length that matches their price range.

- Improved Credit Score: Paying off present loans can enhance your credit score rating, main to higher rates in future monetary endeavors.

Moreover, refinancing can empower debtors with higher mortgage circumstances and even the choice to consolidate a number of loans right into a single cost. To illustrate this benefit, take into account the next hypothetical desk evaluating unique mortgage phrases with potential refinancing choices:

| Loan Type | Original Interest Rate | New Interest Rate | Monthly Payment |

|---|---|---|---|

| Loan A | 7.5% | 4.5% | $350 |

| Loan B | 6.0% | 3.5% | $270 |

Tips for Preparing Your Finances Before Refinancing

Before diving into the refinancing course of, it is essential to assess your present monetary scenario rigorously.Begin by reviewing your credit score rating, as lenders usually supply decrease interest rates to debtors with greater scores. Obtain a duplicate of your credit score report, and dispute any inaccuracies it’s possible you’ll discover. additionally, take into account paying down present money owed to enhance your debt-to-income ratio. This proactive step can’t solely improve your credit score rating however additionally solidify your monetary place within the eyes of potential lenders. Consider these steps:

- Gather Documents: Compile latest pay stubs, tax returns, and any excellent mortgage statements.

- Budget correctly: Create a price range that displays your present monetary obligations to keep away from taking over extra debt than you possibly can deal with.

- Emergency fund: Ensure you may have sufficient financial savings to cowl a minimum of three to six months of bills in case surprising prices come up.

Once you’ve reviewed your monetary standing, it is time to evaluate interest rates from numerous lenders. Investigate on-line assets and monetary establishments to discover the most effective offers, maintaining a tally of any promotional provides. Make positive to take into account the whole value of refinancing, together with any charges, to perceive how it impacts your long-term financial savings. Use the next desk to evaluate potential lenders successfully:

| Lender | present Rate | charges | Estimated Savings |

|---|---|---|---|

| Lender A | 3.5% | $300 | $2,000 |

| Lender B | 3.2% | $200 | $2,500 |

| Lender C | 3.8% | $350 | $1,800 |

Navigating lender Options to Secure the Best Terms

When diving into the world of student mortgage refinancing, understanding the varied lender panorama is essential. Each lender brings distinctive choices, making it important to evaluate their phrases. Start by evaluating potential lenders based mostly on key components:

- Interest Rates: Look for lenders that present aggressive low-interest rates tailor-made to your creditworthiness.

- Fees: Be vigilant about any charges related with the refinance course of, as these can influence your complete prices.

- Repayment Terms: Assess the flexibleness of reimbursement plans, together with choices for deferment and income-driven reimbursement.

- Customer Reviews: Research borrower suggestions to gauge the degree of service and assist every lender provides.

Once you’ve got gathered particulars, take into account making a comparability desk to visualize your choices higher. This might help you streamline your decision-making course of and focus on lenders that meet your monetary wants:

| Lender | Interest Rate Range | Fees | Repayment Options |

|---|---|---|---|

| Lender A | 3.5% – 5.0% | No Fees | Flexible, contains deferment |

| Lender B | 4.0% – 6.5% | Origination Fee 1% | Standard and Income-Driven |

| Lender C | 3.75% – 5.25% | No Fees | Customizable reimbursement phrases |

With this structured method, you will have the option to confidently navigate by means of numerous lenders, making certain you safe essentially the most helpful phrases that align with your refinancing objectives. Make knowledgeable selections and select a lender that amplifies your monetary well-being.

Q&A

**Q&A: How to Refinance Student Loans with Low Interest Rates in 2025**

**Q: What does it imply to refinance student loans?**

A: Refinancing student loans entails taking out a brand new mortgage to repay present student debt. This new mortgage usually comes with a decrease interest charge, probably lowering month-to-month funds and general interest prices.It’s like swapping an outdated pair of footwear for a brand new, extra snug set!

**Q: Why ought to I take into account refinancing my student loans in 2025?**

A: With interest rates persistently fluctuating, 2025 would possibly current a candy spot for refinancing. If present market rates are decrease than your present loans,refinancing coudl prevent cash. plus, student mortgage insurance policies could change, making now a strategic time to take into account a refresher in your mortgage phrases.

**Q: How can I discover low interest rates for refinancing?**

A: Start by buying round! Compare provides from banks, credit score unions, and on-line lenders. Look for lenders focusing on student loans and keep watch over promotional rates, particularly in early 2025, as lenders would possibly decrease rates to entice new debtors.

**Q: What components have an effect on the interest rates I’d obtain?**

A: Several components come into play, together with your credit score rating, earnings, employment standing, and the complete quantity of debt you may have. credit score rating is sort of a golden ticket—it could open doorways to decrease rates, whereas a less-than-stellar rating would possibly lead to greater rates.

**Q: Are there any prices related with refinancing?**

A: While many lenders supply no origination charges, be careful for closing prices or prepayment penalties.Always learn the high-quality print to guarantee no shock prices lurk within the shadows. As they are saying, “The devil is in the details!”

**Q: Can I refinance each federal and non-public student loans?**

A: Yes, you can refinance each forms of loans, however keep in mind: refinancing federal loans with a non-public lender means dropping federal advantages, akin to income-driven reimbursement plans and potential mortgage forgiveness applications. Think rigorously—it is like moving into a complete new realm of mortgage administration!

**Q: What paperwork do I want to put together for refinancing?**

A: Typically, you’ll want proof of earnings (like pay stubs or tax returns), your present mortgage statements, and identification paperwork. Think of this as gathering your treasure map—you need to guarantee you may have all the pieces to navigate easily by means of the refinancing course of.

**Q: How lengthy does the refinancing course of normally take?**

A: Refinancing may be comparatively swift,continuously sufficient accomplished in as little as two to six weeks,relying on the lender. Be ready for preliminary paperwork and interplay, however when you’re on the inexperienced mild, the tip is in sight!

**Q: What ought to I do if I don’t qualify for the finest rates?**

A: Don’t fret! Consider taking steps to enhance your credit score rating, akin to paying down present money owed or making well timed funds in your present loans. Alternatively, you possibly can discover choices like together with a co-signer who has a greater credit score profile—they’ll undoubtedly assist elevate your qualifying possibilities!

**Q: Is there anything I ought to take into account earlier than refinancing?**

A: Absolutely! Take a couple of moments to replicate in your long-term monetary objectives. Sometimes, a decrease month-to-month cost may be engaging, however it would possibly imply extending your mortgage time period. Weigh your choices rigorously—in any case, you’re charting a course to your monetary future!

refinancing your student loans in 2025 might be a savvy transfer for those who do your homework. So roll up your sleeves, dive into the small print, and discover a resolution that works finest for you! Happy refinancing!

In Summary

In the ever-evolving panorama of student mortgage administration, the yr 2025 brings with it a beacon of hope for debtors in search of monetary aid. As you navigate the intricate pathways of refinancing your student loans at low interest rates,keep in mind that information is your strongest ally. Whether you select to pursue a conventional lender or discover progressive choices akin to peer-to-peer lending, the probabilities are plentiful.

Equipped with the insights and techniques outlined on this article, you are actually higher positioned to take management of your monetary future. As you weigh your choices,take into account your private circumstances,and don’t hesitate to search skilled recommendation. The journey in direction of monetary freedom could seem daunting, however every step you’re taking brings you nearer to a brighter tomorrow.

Embrace this chance to forge a new path, scale back your month-to-month funds, and probably even shorten the lifetime of your loans.The selections you make in the present day can resonate lengthy into your future, paving the best way for higher alternatives and peace of thoughts. Here’s to smarter monetary selections in 2025 and past!