As we journey via life, the idea of retirement usually seems like a distant shore—an idyllic paradise shimmering on the horizon, but shrouded in the mists of uncertainty. For many, the 40s signify a pivotal decade, a novel intersection the place youthful ambitions meet the realities of grownup duties. It’s a time when goals of journey, hobbies, and leisurely mornings beckon, but the query looms: have we ready adequately for this subsequent chapter? In this article, we are going to discover sensible steps to fortify your monetary basis for retirement whereas nonetheless having fun with the colourful life you’ve constructed. From assessing financial savings methods to understanding investments and navigating potential pitfalls, we purpose to illuminate a path ahead, arming you with the knowlege wanted to flip that distant paradise right into a tangible actuality. Join us as we delve into the necessities of monetary planning, making certain your golden years shine as brightly as you envision.

Understanding Your Retirement objectives and Lifestyle Aspirations

Defining retirement objectives is a private and empowering journey. In your 40s, it’s important to envision the form of life-style you aspire to preserve or obtain. Consider the next elements that will form your retirement goals:

- Travel Preferences: Do you envision globetrotting or weekend getaways?

- Location: Will you keep in your present house, or transfer to a retirement neighborhood or overseas?

- Hobbies and Activities: What passions or new endeavors do you want to discover?

- Healthcare Needs: Anticipate medical bills as you age.

Once your aspirations are clarified, it is time to translate them into concrete monetary plans. Start by assessing your present financial savings, investments, and any potential earnings sources throughout retirement. Utilize the desk beneath to visualize your monetary panorama:

| earnings Source | estimated Monthly Income | Notes |

|---|---|---|

| 401(ok)/IRA Withdrawals | $2,000 | Based on present contributions and return projections. |

| Social safety | $1,500 | Estimate primarily based on age and earnings historical past. |

| Part-time Work | $1,000 | Consider alternatives aligned with your pursuits. |

| Rental Income | $800 | If you personal funding properties. |

By cultivating a mix of your goals and sensible monetary assessments, you can orchestrate a retirement that really resonates with your life ambitions.

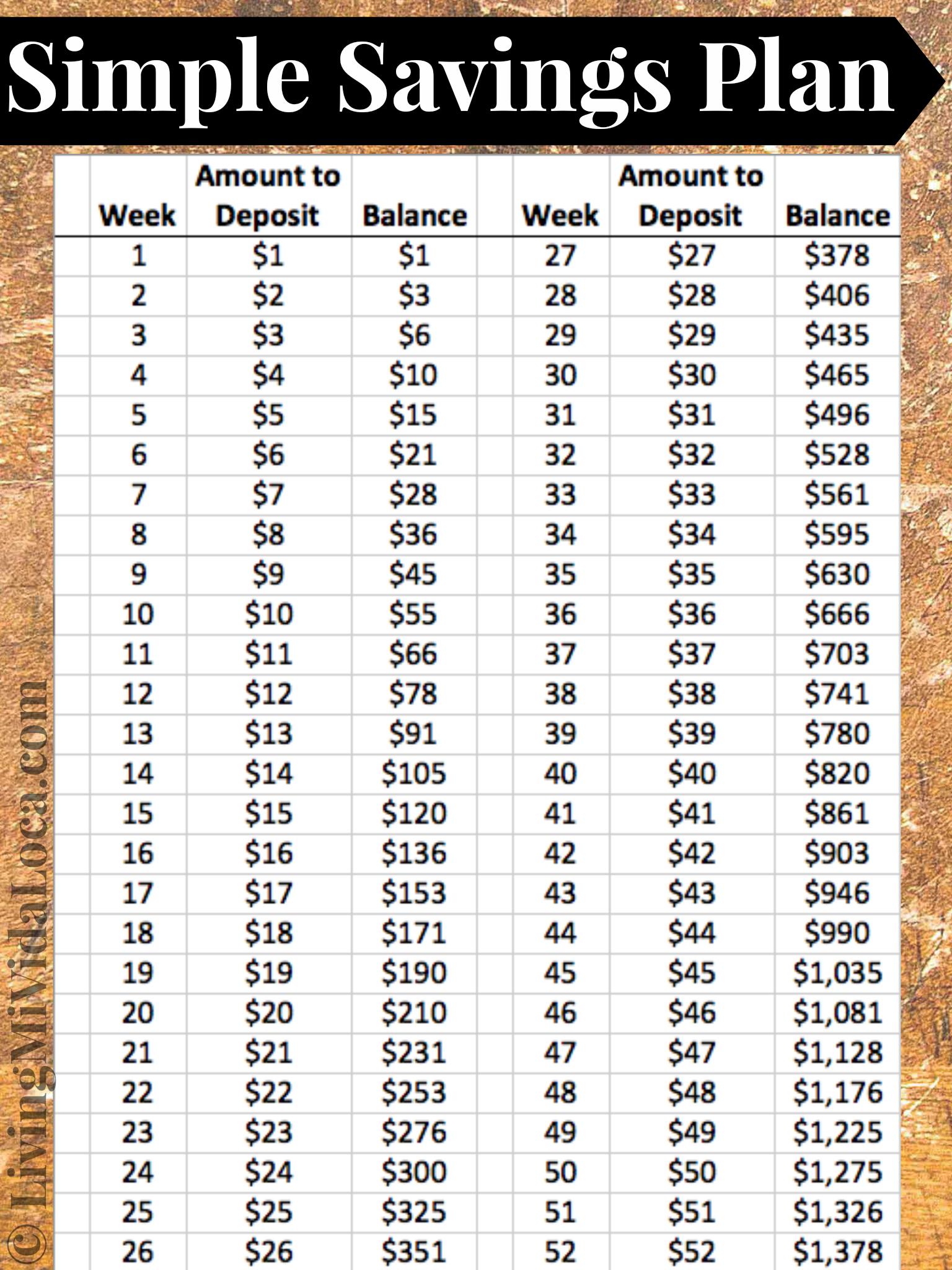

Building a Robust Savings Plan: The Power of Compounding

Creating a financial savings plan that stands the check of time is important for anybody making ready for retirement, and the magic of compounding can considerably improve your efforts. By constantly saving a portion of your earnings,you set the muse for progress. This can contain exploring numerous financial savings choices, such as high-yield financial savings accounts, certificates of deposit, or retirement accounts like 401(ok)s and IRAs.Each contribution to these accounts not solely builds your financial savings however additionally earns curiosity, which finally leads to much more funds generated over time.

Consider the next methods to maximize the potential of compounding:

- Make Regular Contributions: The extra constantly you contribute, the extra you profit from compound progress.

- Start Early: Even small quantities saved early on can lead to substantial sums later due to the compounding impact.

- Reinvest Earnings: Placing dividends and curiosity again into your account can speed up your financial savings progress.

To visualize the facility of compounding, right here’s a easy instance of how your financial savings may develop over time:

| Years | Initial Investment | Annual Contribution | Estimated Total After 20 Years* |

|---|---|---|---|

| 0 | $10,000 | $5,000 | $210,000 |

| 10 | $10,000 | $5,000 | $110,000 |

| 20 | $10,000 | $5,000 | $520,000 |

*Assuming a 6% annual return price.This illustrates how even a modest preliminary funding mixed with common contributions can lead to notable financial savings over time.

Investing Wisely: Diversification Strategies for Your Portfolio

One of essentially the most prudent steps you may take to prepare for retirement in your 40s is to strategically diversify your funding portfolio. By spreading your property throughout numerous courses, you mitigate danger whereas enhancing potential returns. Consider incorporating a combination of **shares**, **bonds**, **actual property**, and **selection investments**. Each of those classes has its personal danger profile and return expectations, which will help stability your general portfolio. Here are some key components to embrace:

- Equities: Invest in a mix of home and worldwide shares.

- Fixed Income: Allocate a portion to authorities and company bonds.

- Real Estate: Explore actual property funding trusts (REITs) or direct property investments.

- Commodities: Consider including valuable metals or vitality property.

- Index Funds: Utilize low-cost index funds for broad market publicity.

Regularly overview and rebalance your portfolio to make sure that your allocations align with your retirement objectives. Over time, sure investments could grow to be overrepresented due to market fluctuations, which may lead to pointless danger. To illustrate the beneficial allocation for a balanced portfolio, refer to the desk beneath:

| Asset Class | Recommended Allocation (%) |

|---|---|

| Equities | 40 |

| Bonds | 30 |

| Real Estate | 20 |

| commodities | 5 |

| Cash or Cash Equivalents | 5 |

Navigating Debt and Expenses: Creating a Sustainable monetary Plan

When it comes to approaching retirement in your 40s, it’s essential to take a tough take a look at your present monetary obligations and bills. constructing a sustainable monetary plan begins with an sincere analysis of your **debt** and **recurring bills**. Begin by itemizing out all your money owed, together with bank card balances, scholar loans, and mortgages. Understanding the place you stand will assist in making a roadmap to sort out every obligation. think about adopting methods such as the **debt snowball** or **debt avalanche** strategies, which prioritize your repayments in methods that can prevent cash and cut back stress over time.

In addition to managing present debt, a radical evaluation of your **month-to-month bills** is important to bolster your retirement financial savings. Categorize your spending into wants and desires to determine areas the place you may in the reduction of.This may imply reassessing subscription companies or eating habits. Here’s a easy breakdown in desk format:

| Category | Needs | Wants |

|---|---|---|

| Housing | Mortgage/Rent | Upgrades/Renovations |

| Food | Groceries | Dining Out |

| Transportation | Car Payments | Luxury Cars |

Once you’ve got bought a clearer image, reroute any funds saved from chopping pointless bills immediately into your retirement accounts. Implementing these practices not solely creates a monetary cushion but in addition builds good habits for long-term safety.

Q&A

**Q&A: How to Prepare Financially for Retirement in Your 40s**

**Q1: Why is my 40s a essential time to give attention to retirement planning?**

A1: Your 40s are a pivotal decade for retirement planning as they incessantly sufficient function a crossroads. You could discover your profession is at its peak, permitting for greater earnings potential, and any youngsters you’ve could be getting nearer to independence.This monetary bandwidth supplies a novel alternative to ramp up your retirement financial savings and make strategic investments.

**Q2: What are the important thing steps I ought to take to begin making ready financially for retirement?**

A2: Start by assessing your present monetary standing—take inventory of your financial savings, money owed, and life-style bills. Create a finances that displays your retirement objectives. purpose to maximize contributions to retirement accounts (like a 401(ok) or IRA) and discover extra funding choices akin to shares or actual property. It’s additionally important to set up an emergency fund to safeguard in opposition to unexpected circumstances.

**Q3: How a lot ought to I be saving for retirement in my 40s?**

A3: A standard rule of thumb is to save about 15% of your gross earnings for retirement. By your mid-40s, purpose to have three to six occasions your annual wage saved. However, this will fluctuate primarily based on your retirement objectives, life-style expectations, and when you propose to retire, so it is important to create a customized financial savings plan that aligns with your aspirations.

**This autumn: What kinds of accounts ought to I prioritize for retirement financial savings?**

A4: Start by maximizing contributions to tax-advantaged retirement accounts, such as a 401(ok) or a Roth IRA. If your employer presents an identical contribution,take full benefit of it—that is primarily free cash! Beyond these,think about taxable funding accounts for extra financial savings adaptability.

**Q5: How can I stability saving for retirement with different monetary objectives, like paying off scholar loans or shopping for a home?**

A5: Create a holistic monetary plan prioritizing your objectives primarily based on timelines and influence. Consider the “50/30/20” rule: allocate 50% of your earnings to wants, 30% to needs, and 20% to financial savings and debt. alter these as vital—if you are paying off high-interest debt, prioritize that first, then shift focus to retirement financial savings as soon as you are extra snug.

**Q6: What funding methods ought to I think about in my 40s?**

A6: Diversification is essential. As you’re possible nearing the midpoint of your profession, think about a balanced mixture of shares, bonds, and different property to strike a stability between danger and progress. You could wont to shift to a extra conservative funding technique over the following few a long time to shield your financial savings as you strategy retirement. look into target-date funds that mechanically alter asset allocation as you close to retirement age for a extra hands-off strategy.

**Q7: How can I make sure that I keep on observe with my retirement financial savings?**

A7: Regularly overview your monetary plan—writing down your objectives and reviewing them yearly can sharpen your focus. Utilize instruments like retirement calculators to challenge your financial savings and alter as vital. Having accountability—whether or not via monetary advisors or household discussions—may also assist hold you motivated and on observe.

**Q8: What irreplaceable recommendation may you give somebody in their 40s who feels overwhelmed by retirement planning?**

A8: Start small and give attention to incremental adjustments slightly than drastic shifts. Educate your self constantly; information is energy in retirement planning. Celebrate milestones alongside the manner, whether or not reaching a financial savings aim or decreasing debt, to construct momentum. Remember, it’s by no means too late to start, and every small step you take now can have a major influence on your future.

**Conclusion**: If you embrace the journey of monetary planning in your 40s with a mix of technique and flexibility, you may carve a safe path towards the retirement you envision. A little foresight at this time can lead to extra peace of thoughts tomorrow.

Future Outlook

As you strategy your 40s, the horizon of retirement may really feel distant, but it’s an opportune second to lay a strong monetary basis for your future. By taking the steps outlined in this text—evaluating your present monetary standing,maximizing retirement contributions,diversifying investments,and planning for healthcare-you can rework a nebulous dream right into a tangible aim. Remember, this journey shouldn’t be simply about accumulating wealth; it is about securing peace of thoughts and the liberty to get pleasure from life on your personal phrases in your later years.

So, as you navigate the complexities of monetary planning, think about the probabilities forward: a future crammed with journey, hobbies, and high quality time with family members. With proactive methods and a considerate strategy, you can create a retirement that displays your aspirations. While the highway could be lengthy, every monetary determination you make at this time is a step nearer to a satisfying tomorrow. Embrace this chapter of preparation with optimism, and watch as your imaginative and prescient for retirement unfolds into a rewarding actuality.