In a world have been monetary freedom often sufficient looks like an elusive dream, the burden of debt can weigh closely on our minds and wallets.Whether it’s pupil loans, bank card balances, or surprising medical payments, being in debt can led to stress, nervousness, and a sense of helplessness. However, simply as each cloud has a silver lining, there are sensible methods that may assist flip that debt dilemma into a manageable journey towards monetary independence. In this text, we are going to discover seven confirmed strategies to speed up yoru path to changing into debt-free, empowering you with the instruments and insights obligatory to regain management of your monetary future. Join us as we delve into actionable steps that can lighten the load and set you on a course to lasting monetary well being.

Strategies for Budgeting Effectively to Free up Funds

Creating a sensible funds is important for liberating up funds that may be redirected towards debt compensation. Start by monitoring your spending for at least a month to establish the place your cash goes. You is likely to be shocked to uncover *non-essential bills* that may be trimmed down. Prioritize your bills by categorizing them into **wants** and **needs**, which permits you to see potential areas for financial savings. Once you’ve gotten a transparent image, set particular limits for every class, making certain that you just allocate a portion towards debt compensation.

To improve your budgeting effectiveness, contemplate using the **50/30/20 rule** as a framework. This in style methodology divides your revenue into three foremost classes: **50% for wants**, **30% for needs**, and **20% for financial savings and debt compensation**.You can create a easy desk to monitor your funds effectively:

| Category | Percentage | Example Allocation ($5000 revenue) |

|---|---|---|

| Needs | 50% | $2500 |

| Wants | 30% | $1500 |

| Savings & Debt | 20% | $1000 |

By committing to this breakdown, you empower your self to make aware spending choices whereas steadily growing the funds out there for debt elimination.Additionally, **assessment and alter your funds** month-to-month to accommodate any adjustments in revenue or bills, making certain that you just keep on monitor towards your monetary objectives.

Leveraging the Snowball and Avalanche Methods for Maximum Impact

When it comes to paying off debt, two in style methods, the Snowball methodology and the Avalanche Method, might help you obtain monetary freedom extra successfully. The Snowball Method focuses on paying off your smallest money owed first, which may present psychological advantages and encourage you to keep dedicated to your debt compensation journey. By eliminating these smaller money owed early on, you can construct momentum and create a way of accomplishment. This methodology encourages you to have a good time every debt you repay, fostering a optimistic mindset as you deal with bigger quantities.

Conversely, the Avalanche Method is designed for these who need to decrease curiosity funds over time. This strategy prioritizes paying off high-interest money owed first, which may prevent cash in the lengthy run. By focusing on the money owed that incur the very best prices, you cut back the general curiosity you’ll pay, in the end permitting your cash to work tougher for you. Whether you select the Snowball or Avalanche Method, it’s essential to stay constant and devoted to your compensation plan. Consider creating a easy desk to monitor your progress and encourage your self:

| Debt Type | Amount Owed | Interest Rate | Minimum Payment |

|---|---|---|---|

| Credit Card A | $1,200 | 18% | $50 |

| Medical Bill | $800 | 0% | $30 |

| Personal Loan | $3,000 | 12% | $100 |

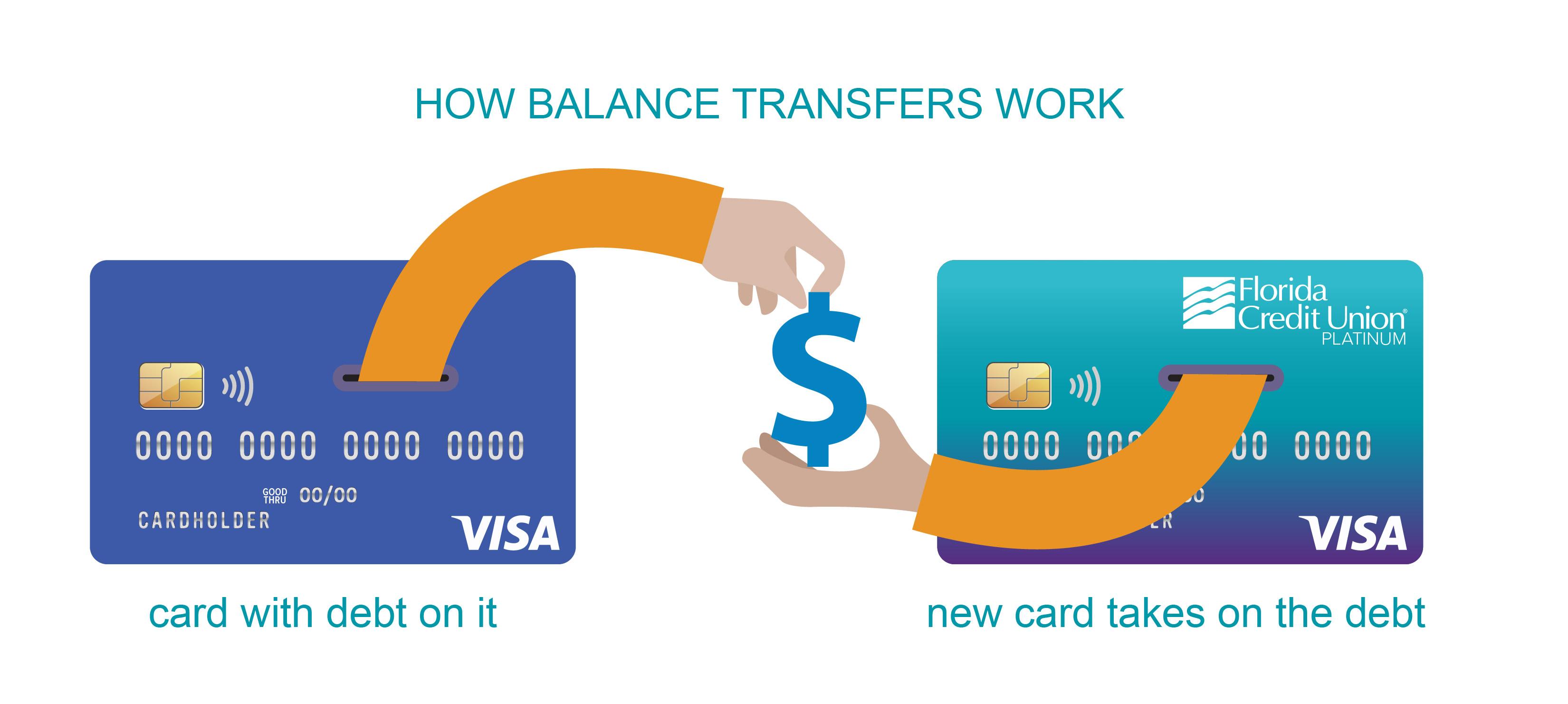

Exploring Balance Transfers and Debt Consolidation Options

When grappling with debt, exploring choices like steadiness transfers and debt consolidation can pave the manner in the direction of monetary aid. **Balance transfers** enable people to transfer their high-interest bank card debt to a brand new card with a decrease curiosity price,typically for an introductory interval. this may lead to essential financial savings and assist expedite debt compensation. It’s essential to assess the **phrases and costs** related to the brand new card and be certain that the complete prices stay decrease than the prevailing debt. Conversely, **debt consolidation** includes taking out a mortgage to repay a number of money owed, simplifying your compensation course of right into a single month-to-month cost. This methodology not solely eases administration however can also decrease your general rate of interest,relying in your credit score profile and the sort of mortgage secured.

Choosing the fitting strategy is determined by varied components akin to your present monetary state of affairs, credit score rating, and general debt quantity. Here are some components to contemplate when evaluating each choices:

- Interest Rates: Compare the charges of your present money owed with potential balances or loans.

- Fees: Be conscious of any switch charges or origination prices related to new loans.

- Repayment Terms: Look for favorable and manageable phrases that match inside your funds.

- Impact on Credit Score: Understand how every possibility can affect your credit score profile over time.

| Option | execs | Cons |

|---|---|---|

| Balance Transfer | Lower curiosity, easy administration | Possible charges, introductory charges expire |

| Debt Consolidation | Single cost, maybe decrease price | Loan necessities, charges might apply |

(*7*)The Role of Financial Education in Sustained Debt Management

Understanding the intricacies of private finance can dramatically affect one’s capacity to handle and get rid of debt successfully. Financial training equips people with the mandatory instruments to make knowledgeable choices concerning budgeting, saving, and spending, fostering a mindset geared in the direction of sustained monetary well being. Individuals who make investments time in studying about curiosity charges, compensation methods, and the implications of credit score scores can significantly cut back missteps that usually contribute to escalating debt. By greedy these ideas, debtors can prioritize their money owed and develop actionable plans that lead to quicker compensation, therefore assuaging the psychological burden that accompanies monetary pressure.

Moreover, monetary literacy is a steady journey that enhances one’s resilience towards future debt. Individuals with a stable basis in monetary rules are higher ready to navigate financial downturns, surprising bills, and even life-style adjustments that can derail monetary stability. Programs that foster ongoing training in finance often sufficient embrace interactive workshops, on-line programs, and group discussions that reinforce these abilities. Notably, constructing a supportive group round monetary training can lead to shared experiences and methods, empowering members to maintain one another accountable of their debt administration efforts.

Q&A

**Q&A: How to Pay Off Debt Faster: 7 Proven Methods**

**Q: What’s the first step I ought to take to pay off my debt extra rapidly?**

A: The first step is to get a transparent image of your monetary state of affairs. take an stock of all of your money owed,together with the entire quantities owed,curiosity charges,and month-to-month funds.This readability will empower you to create a strategic compensation plan.

—

**Q: Why is it critically essential to prioritize sure money owed over others?**

A: Prioritizing debt helps you give attention to essentially the most pricey liabilities first. Typically, you may need to deal with high-interest money owed—like credit score playing cards—since they will accumulate extra curiosity over time, which will increase the complete quantity you owe.

—

**Q: I’ve heard concerning the snowball methodology. Can you clarify how that works?**

A: Absolutely! The snowball methodology includes paying off your smallest money owed first whereas making minimal funds on bigger money owed. Once the smallest debt is cleared, you roll that cost into the subsequent smallest debt.This creates a “snowball” have an effect on, offering motivation by swift wins as you get rid of money owed.

—

**Q: What’s the distinction between the snowball methodology and the avalanche methodology?**

A: The snowball methodology focuses on the psychological increase of clearing small money owed first, whereas the avalanche methodology addresses money owed with the highest curiosity charges first.The avalanche methodology might prevent extra cash in curiosity over time, however the snowball methodology can hold you motivated and engaged.

—

**Q: Can making a funds actually assist me pay off debt?**

A: Definitely! Creating a funds permits you to allocate your revenue extra successfully, making certain you’ve gotten sufficient to cowl important bills whereas directing additional funds in the direction of your debt compensation.A well-structured funds can spotlight areas the place you’ll be able to reduce and improve financial savings.

—

**Q: How can growing my revenue assist me repay debt quicker?**

A: Increasing your revenue supplies extra funds to put in the direction of your debt compensation efforts. You may contemplate facet gigs, freelance work, and even asking for a increase. Every further greenback you earn could be channeled straight into your debt, accelerating your journey to monetary freedom.

—

**Q: Are there any strategies for decreasing rates of interest on my debt?**

A: sure! You can negotiate decrease rates of interest with your collectors, significantly if you’ve gotten a great cost historical past. Additionally, transferring high-interest credit score card balances to a card with a decrease price or exploring private mortgage choices for consolidation can save you cash in curiosity funds.

—

**Q: Is it ever a good suggestion to tackle new debt whereas paying off present debt?**

A: While it’s usually advisable to keep away from taking up new debt whereas repaying present obligations, there could be exceptions. If buying a new debt can positively assist you consolidate outdated money owed at a decrease curiosity price or enhance your monetary standing in the long term, it is likely to be price contemplating. Always consider the potential dangers and advantages rigorously.

—

**Q: What’s the ultimate piece of recommendation for somebody wanting to pay off debt quicker?**

A: Stay dedicated and be affected person! Regularly assessment your funds, have a good time small victories, and alter your plan as wanted. Remember, the journey to changing into debt-free is a marathon, not a dash—every step ahead is progress towards a more healthy monetary future.

In Conclusion

As we conclude our exploration of efficient methods for accelerating your journey to a debt-free life, bear in mind that your path is probably not a straight line. Embracing these seven confirmed strategies can rework the best way you handle your funds and enable you to regain management over your financial future.

Each step taken—whether or not it is refining your funds, negotiating decrease charges, or discovering further revenue streams—brings you nearer to monetary freedom. The key’s consistency, dedication, and a willingness to adapt as you be taught what works finest on your distinctive state of affairs.

As you embark on this rewarding endeavor, hold in thoughts that paying off debt isn’t just about numbers on a steadiness sheet; it’s about reclaiming your peace of thoughts and opening doorways to new alternatives.have a good time every small victory, and don’t hesitate to search help when wanted. Your dedication to these strategies can pave the manner for a brighter, extra safe monetary future.

Here’s to taking again your energy and stepping right into a life unburdened by debt!