In the dynamic world of startups, the place innovation reigns supreme and ambition fuels each determination, one basic actuality stays fixed: cash flow is the lifeblood of any thriving business.Yet, for a lot of entrepreneurs, managing cash flow can really feel like navigating a treacherous ocean—one second you’re using the waves of success, and the following, you’re struggling in opposition to an unrelenting tide of bills and uncertainties. Understanding how to effectively manage cash flow is not only a monetary necessity; it’s a essential ability that may differentiate between the survival and failure of fledgling ventures. In this article, we’ll discover sensible methods and insightful ideas that may empower you to acquire management over your cash flow, guaranteeing that your startup not solely stays afloat but additionally sails in direction of profitability and progress. Let’s embark on this journey collectively, remodeling your monetary challenges into a roadmap for achievement.

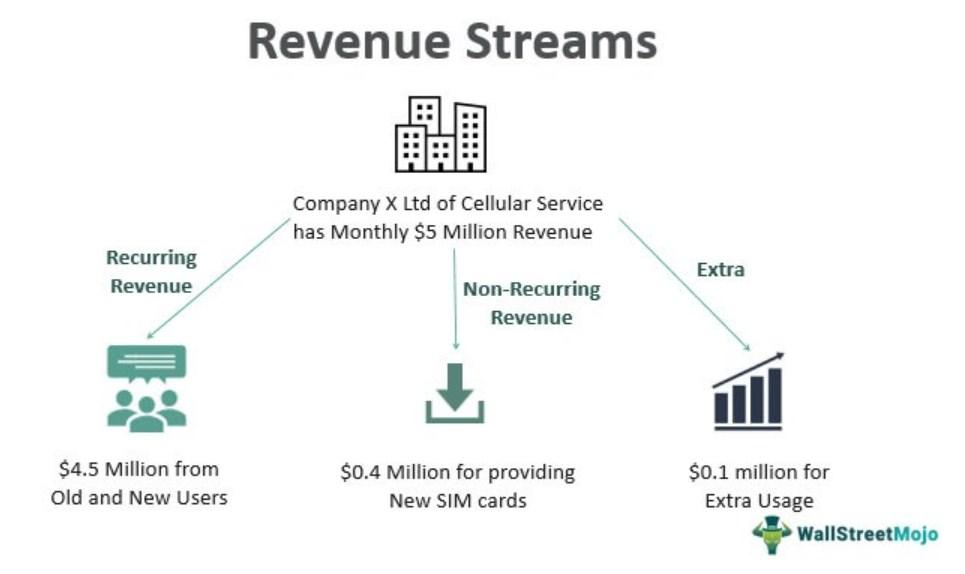

Navigating Revenue Streams to Optimize Cash Flow

startups often sufficient function on tight margins, making it important to discover numerous income streams that may improve cash flow. Consider the following methods to create a number of revenue sources:

- Diversify Product Lines: Introducing complementary merchandise can appeal to a broader buyer base and encourage repeat purchases.

- Subscription Models: Implementing a subscription-based service can present constant income and improve buyer loyalty.

- Collaborations: Partnering with different companies for joint choices can develop your attain with out heavy funding.

- Freemium Options: Offering a free tier with improve choices can entice new prospects whereas offering alternatives for upselling.

Once you’ve got established varied income streams, it is essential to monitor their efficiency and impression on cash flow commonly. Utilizing a easy monitoring system will show you how to perceive which streams are moast worthwhile. An instance of a monitoring desk is proven beneath:

| Revenue Stream | Monthly Revenue | Growth Rate |

|---|---|---|

| Product Sales | $5,000 | 15% |

| Subscription Services | $2,500 | 20% |

| Affiliate advertising | $1,000 | 10% |

| Online Courses | $3,000 | 25% |

Tracking these metrics permits for data-driven decision-making to reallocate assets effectively and maximize income, finally guaranteeing smoother cash flow administration.Taking proactive steps to manage and diversify income can form a startup’s monetary panorama for the higher.

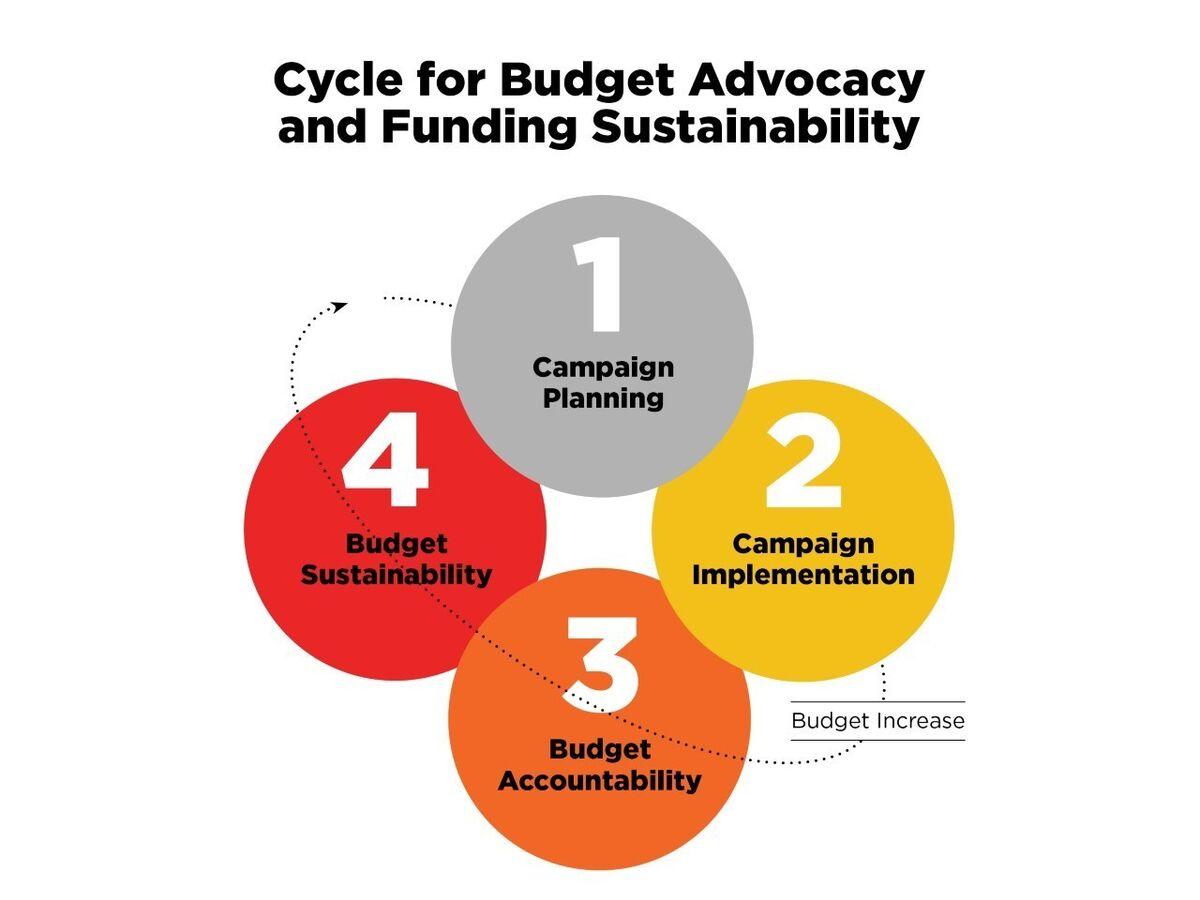

Building a Robust budgeting Framework for Startups

Creating a stable budgeting framework for startups is crucial to guarantee monetary stability and seamless operations. A well-structured finances permits founders to plan for future bills, monitor cash flow, and anticipate potential challenges. Here are some key elements to think about when creating your finances:

- Income Projections: Estimate your income based mostly on market analysis and gross sales forecasts.

- Fixed and Variable Costs: Distinguish between prices that stay fixed and these that fluctuate.

- Emergency Fund: Set apart capital for unexpected occasions to keep away from cash flow disruptions.

- Short-term vs Long-term Goals: Prioritize spending that aligns along with your startup’s progress trajectory.

Having a clear view of your monetary well being also can be completed via common monitoring and changes to your finances. Consider implementing the next practices:

- Monthly Reviews: Assess your monetary efficiency month-to-month to establish any deviations from the finances.

- Cloud-Based Tools: Utilize budgeting software program to streamline monitoring and collaboration amongst crew members.

- Expense Tracking: Maintain a detailed document of expenditures to assist spot areas for potential financial savings.

- Scenario Planning: Prepare for varied outcomes by modeling totally different cash flow situations.

| Budget Aspect | Importance |

|---|---|

| Income Projections | Guides income targets |

| Fixed Costs | Ensures baseline bills are lined |

| Variable Costs | Helps predict monetary adaptability |

| Emergency Fund | Protects in opposition to sudden downturns |

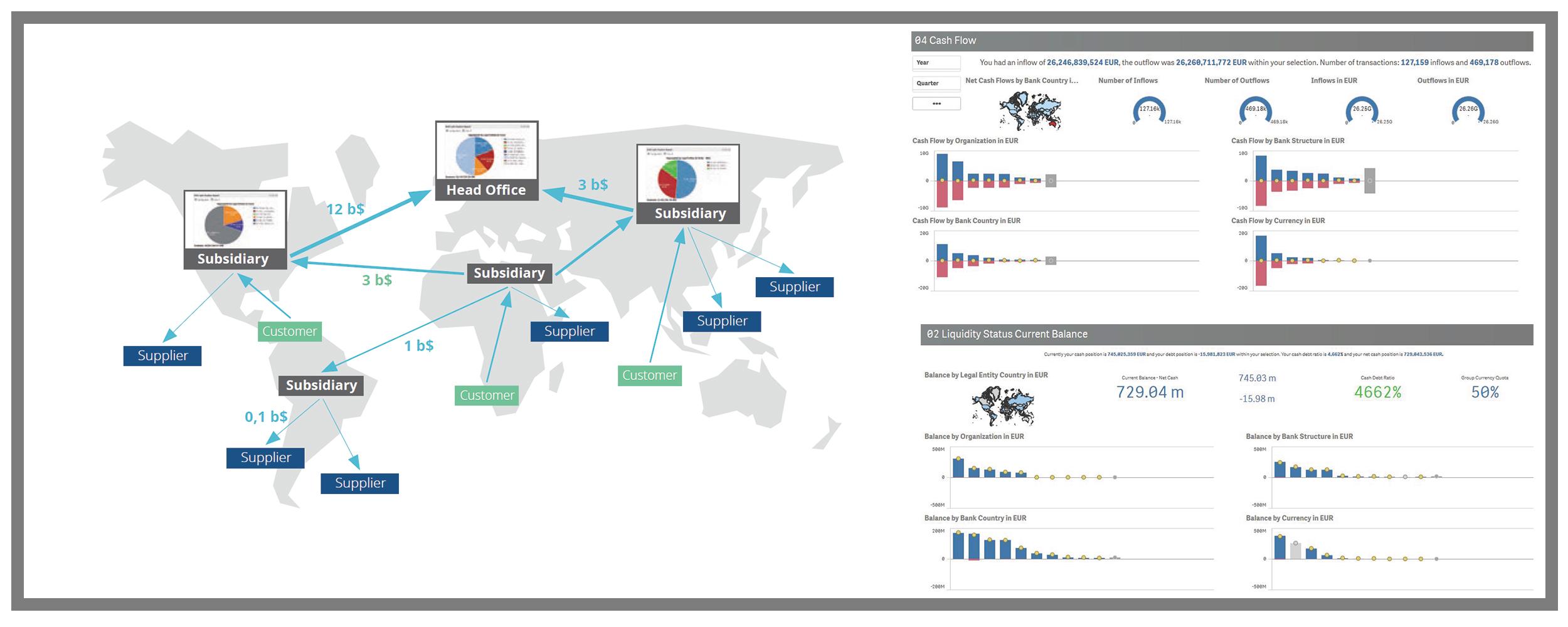

Leveraging Technology for Real-Time Cash flow Monitoring

In right this moment’s digital panorama, harnessing the energy of expertise can significantly improve your startup’s cash flow administration.By using real-time monitoring instruments, you may acquire immediate insights into your monetary standing, enabling you to make knowledgeable choices shortly.With options like automated cash flow forecasts and spending notifications, you’ll be one step forward, ready to deal with potential cash shortfalls earlier than they escalate. Consider implementing instruments that combine along with your accounting software program to streamline knowledge entry and synchronize varied monetary features.

To maximize the effectiveness of those applied sciences, it’s important to focus on the next elements:

- Cloud-Based Solutions: Access your monetary knowledge from anyplace, facilitating smarter decision-making.

- Mobile Apps: Stay up to date on cash flow analytics and metrics on-the-go.

- Custom Alerts: Set thresholds for spending and revenues to obtain notifications that maintain you knowledgeable.

| Tool Name | Features | worth Range |

|---|---|---|

| quickbooks | Real-time reporting, invoicing | $25 – $180/month |

| CashFlowTool | Forecasts, spending evaluation | $29 – $79/month |

| Float | budgeting, integration with accounting software program | $39 – $99/month |

Strategic Cost administration to Enhance Financial Health

In right this moment’s aggressive panorama, efficient cash flow administration is essential for a startup’s progress and sustainability.By **strategically controlling prices**, startups can unlock cash for important business actions. This entails evaluating each expense and figuring out areas for discount or elimination.Key methods embody:

- Energizing Vendor Relations: Negotiate higher fee phrases and reductions with suppliers to improve liquidity.

- Embracing Technology: Utilize monetary software program to automate invoicing and fee reminders,guaranteeing immediate collections.

- Monitoring Inventory Efficiently: Maintain optimum stock ranges to keep away from tying up cash in unsold merchandise.

Moreover, creating a monetary dashboard is instrumental in monitoring efficiency indicators that have an effect on cash flow. Startups ought to deal with the next metrics:

| Metric | Description |

|---|---|

| Burn Rate | Monthly expenditure to monitor cash depletion. |

| Cash Conversion Cycle | Time taken to convert stock into cash. |

| Days Sales Outstanding (DSO) | Average days to acquire funds after a sale. |

By persistently reviewing these metrics, startups can proactively alter their methods, optimize operations, and finally strengthen their monetary place for the lengthy haul.

Q&A

**Q: What is cash flow, and why is it essential for a startup?**

**A:** Cash flow refers to the motion of cash in and out of your business. It’s essential for startups as it ensures you’ve gotten sufficient liquidity to cowl each day operations, pay workers, and make investments in progress alternatives. Without optimistic cash flow,even worthwhile companies can face dire penalties,as payments and bills can shortly accumulate.

—

**Q: What are some widespread cash flow challenges that startups face?**

**A:** Startups often sufficient encounter points like inconsistent income streams, excessive preliminary bills, late funds from purchasers, and the unpredictability of market demand. These challenges can lead to cash shortages that will hinder operations or stall progress.

—

**Q: How can I create a dependable cash flow forecast?**

**A:** To create a cash flow forecast, begin by itemizing all sources of revenue, together with anticipated gross sales and funding. Then, define your bills — each fastened and variable. Use historic knowledge when obtainable or business benchmarks to make educated estimates about future inflows and outflows.A month-by-month projection can present a clearer image of when cash may be tight.

—

**Q: What methods can I implement to enhance cash flow?**

**A:** Some efficient methods embody:

1. **Streamlining Billing Processes:** Send invoices promptly, set clear fee phrases, and think about providing reductions for early funds.

2. **Managing Inventory Wisely:** Keep a lean stock to scale back holding prices and reduce waste.

3.**Negotiating with Suppliers:** attempt to lengthen fee phrases or negotiate reductions on bulk orders.

4. **Identifying and Reducing Needless Expenses:** Regularly evaluation bills and reduce out non-essential prices to enhance your backside line.

—

**Q: Is it advisable to use credit score to manage cash flow?**

**A:** Utilizing credit score can be a double-edged sword. While it will probably present short-term reduction in cash flow crises, relying too closely on credit score can lead to debt accumulation and elevated monetary pressure. It’s finest to use credit score strategically and guarantee you’ve gotten a stable plan for reimbursement.—

**Q: How essential is constructing a cash reserve for a startup?**

**A:** Building a cash reserve is extremely necessary for a startup. A reserve acts as a security web throughout lean intervals or unexpected bills.Aim to save at the least a few months’ price of working bills so that you have a buffer that may assist maintain your business throughout fluctuations.

—

**Q: What function does monitoring cash flow play in managing a startup?**

**A:** Monitoring cash flow is paramount to knowledgeable decision-making. Regularly reviewing cash flow statements helps you notice tendencies, establish potential shortfalls, and alter your monetary technique.Tools and software program can help with monitoring cash flow in actual time,making the method extra environment friendly and correct.

—

**Q: How can I leverage expertise to improve cash flow administration?**

**A:** Technology can considerably improve your cash flow administration by automating invoicing, monitoring bills, and predicting cash flows. Software like accounting applications or cash flow administration instruments supplies dashboards and experiences that grant readability and streamline duties,permitting you to focus on strategic planning as an alternative of mundane bookkeeping.—

**Q: Is it essential to seek the advice of a monetary advisor for cash flow administration?**

**A:** While not necessary, consulting a monetary advisor can present invaluable insights and methods tailor-made to your particular scenario. Their experience can undoubtedly assist you establish potential pitfalls and seize alternatives that may go unnoticed, finally contributing to a extra sturdy monetary technique on your startup.

Concluding Remarks

In the dynamic panorama of startups, cash flow administration emerges because the lifeblood that sustains progress and innovation. As we have explored, implementing efficient methods—starting from diligent forecasting to embracing expertise—can empower you to navigate the challenges that come your approach. Remember, managing cash flow is not simply about balancing the books; it is about fostering a resilient business that may thrive amid uncertainty.

As you embark on this journey, maintain your eyes on the monetary horizon, adapt to the ever-changing tides, and domesticate a proactive mindset. With cautious planning and strategic insights, you’ll not solely preserve the heartbeat of your startup but additionally lay the groundwork for lasting success. In the world of entrepreneurship, each greenback tells a story—ensure that yours narrates a story of progress, stability, and boundless potential.