In the ever-evolving panorama of the inventory market, figuring out the appropriate investments for long-term development can incessantly sufficient really feel like navigating a labyrinth. With numerous choices obtainable, every promising potential returns, the problem lies in discerning which shares can face up to the check of time adn financial fluctuations. As we embark on this monetary journey, we’ll discover a number of standout corporations that not solely prioritize innovation and stability however additionally mirror the heartbeat of business developments and client calls for. Whether you’re a seasoned investor or simply beginning out,understanding the fundamentals and long-term methods behind these shares can illuminate your path in direction of constructing a sturdy portfolio. Join us as we unveil the perfect shares to contemplate for sustainable development in the years to come.

Identifying Growth Potential: Key Metrics for Selecting Stocks

When it comes to uncovering shares with notable development potential, a number of key metrics can function indicators of an organization’s future success. Investors ought to contemplate elements such as earnings development fee, which displays how shortly a firm’s earnings are rising. A constant upward trajectory in earnings per share (EPS) can point out sturdy administration and enterprise methods.Additionally, the price-to-earnings (P/E) ratio may also help traders gauge whether or not a inventory is undervalued or overpriced relative to its earnings. A decrease P/E ratio in contrast to business friends might recommend a hidden gem ready for discovering.

Another important metric is the free money circulation (FCF), which demonstrates how a lot money an organization generates after accounting for capital expenditures. Positive FCF signifies an organization’s means to fund its development initiatives with out counting on exterior financing, additional enhancing its sustainability. Moreover, analyzing the return on fairness (ROE) can supply insights into how successfully an organization is utilizing its fairness to generate income. Companies with excessive and constant ROE are usually seen as sturdy opponents inside their sectors, indicating potential for long-term development.

Emerging Industries to Watch: Where Innovation Meets Investment

The panorama of funding is quickly evolving, creating ripe alternatives inside rising industries that are primed for exponential development. areas corresponding to renewable power, synthetic intelligence, and biotechnology are usually not simply buzzwords; they signify the forefront of technological development and sustainability. Investing in corporations that are pioneers in these sectors can be extremely profitable,particularly as international demand shifts towards greener options and superior applied sciences. Consider trying intently at corporations concerned in:

- Electric autos (evs) – Companies growing cutting-edge EV expertise or infrastructure.

- Clean power – Businesses specializing in photo voltaic,wind,and different renewable power sources.

- AI and machine studying – Firms harnessing information to revolutionize industries from healthcare to finance.

- Healthcare innovation – Companies creating superior medical gadgets and prescription drugs.

Investors also needs to maintain an eye fixed on the potential development of sectors corresponding to house expertise and metaverse progress. As nations and non-public entities make investments closely in house exploration and applied sciences associated to the digital universe, alternatives for worthwhile ventures have gotten extra obvious. Below is a desk showcasing some of the notable corporations in these fields,highlighting their dedication to innovation and market potential:

| Company Name | Sector | Overview |

|---|---|---|

| Rivian Automotive | Electric Vehicles | Focuses on electrical vehicles and SUVs with sustainable expertise. |

| NextEra Energy | Renewable Energy | Leader in wind and photo voltaic power manufacturing. |

| Palantir Technologies | AI & Data Analytics | Provides AI-driven options for large-scale information interpretation. |

| CRISPR Therapeutics | Biotechnology | Innovative gene modifying applied sciences for therapeutic functions. |

Blue-Chip Stocks: Stability and Reliability for Long-Term Gains

Investing in blue-chip shares is commonly considered an indicator of sound monetary technique. These corporations have stood the check of time, demonstrating sturdy efficiency and resilience towards market volatility. Known for their **reliability** and **stability**, blue-chip shares belong to well-established corporations with a observe report of constant earnings, dividend payouts, and sturdy monetary well being. As a long-term funding, they supply not simply potential appreciation in share worth but in addition a dependable earnings stream, making them enticing for traders looking for to construct a sustainable portfolio.

Some important traits of blue-chip shares embrace:

- Market Leadership: They usually led their respective industries.

- monetary Stability: Strong stability sheets and constant money circulation.

- Reputable Dividends: History of dividend funds that incessantly sufficient develop over time.

- Global Presence: Many are multinational companies with various income streams.

Below is a easy overview of some distinguished blue-chip shares recognized for their long-term development potential:

| Company | Sector | Market Cap ($B) | Dividend Yield (%) |

|---|---|---|---|

| apple Inc. | Technology | 2,500 | 0.56 |

| Johnson & Johnson | Healthcare | 470 | 2.48 |

| coca-Cola | Consumer Staples | 260 | 3.07 |

| Procter & Gamble | Consumer Goods | 360 | 2.40 |

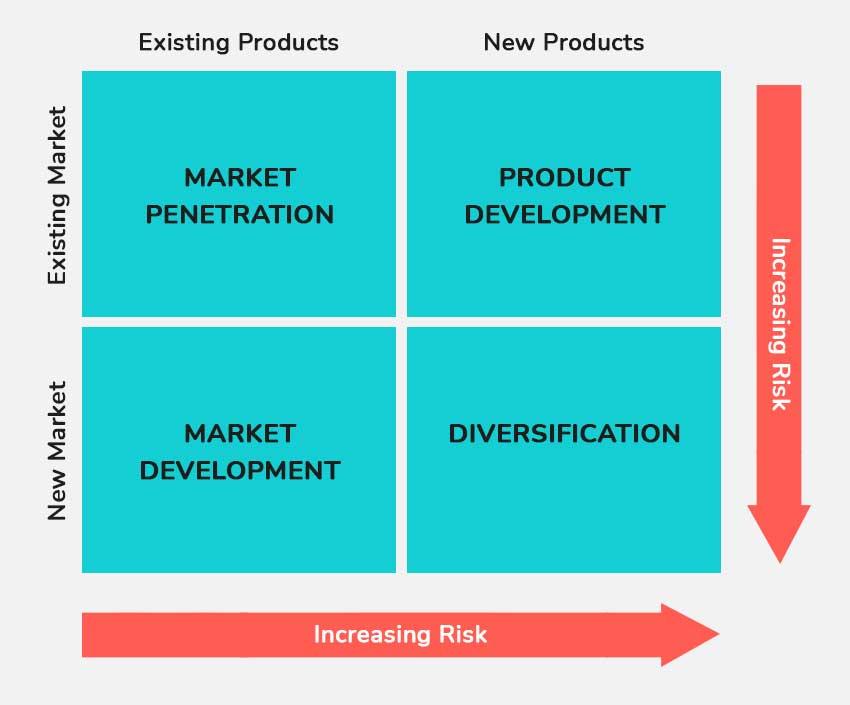

Diversification Strategies: Balancing Risk and alternative in Your Portfolio

incorporating a wide range of property into your funding portfolio is important for navigating the shifting panorama of the inventory market. By **embracing diversification**, you not solely mitigate dangers but in addition improve your probabilities for rewarding returns. Here are a couple of approaches to contemplate:

- Sector Allocation: Invest throughout completely different sectors such as expertise,healthcare,and client items to safeguard towards business downturns.

- Geographic Diversification: Explore shares from numerous areas, together with rising markets, to faucet into international development alternatives.

- Asset Class Mix: Combine equities with bonds and actual property to stability volatility whereas capturing potential upside.

Understanding the **danger versus reward** ratio is vital to efficient funding choices. Maintaining a well-balanced portfolio might contain reviewing asset allocation periodically and adjusting primarily based on efficiency and market circumstances. The following desk affords a snapshot of some prime candidates for long-term development:

| Stock | Sector | 5-year Growth Avg (%) |

|---|---|---|

| Apple Inc. | Technology | 15% |

| Tesla Inc. | Automotive | 30% |

| johnson & Johnson | Healthcare | 9% |

| Procter & Gamble | Consumer Goods | 5% |

Q&A

## Q&A: Best Stocks to Invest in for Long-Term development

**Q1: What ought to traders contemplate when trying for shares with long-term development potential?**

A1: Investors ought to deal with a number of key elements, together with a firm’s monetary well being, market place, and development prospects. Look for companies with constant income and earnings development, sturdy aggressive benefits, and a sturdy administration group. Additionally, it is important to assess the business developments and the corporate’s means to adapt to adjustments in the market over time.

—

**Q2: Are there particular sectors that have a tendency to carry out higher for long-term development?**

A2: Historically, sure sectors like expertise, healthcare, and renewable power have proven substantial development potential. Technology corporations innovate at a speedy tempo, whereas healthcare corporations profit from getting older populations and developments in medical science. renewable power is on the rise as the world focuses on sustainability. However, diversification throughout sectors can mitigate dangers and improve development prospects.

—

**Q3: How essential is dividend yield when deciding on shares for long-term development?**

A3: dividend yield is a consideration,however it shouldn’t be the only real focus when deciding on shares for long-term development.While corporations that pay dividends incessantly sufficient exhibit monetary stability, high-growth corporations might reinvest their income to gas additional enlargement. A balanced strategy that features development shares and dependable dividend-paying shares can present the advantages of each capital appreciation and earnings technology.

—

**This autumn: Can you present examples of corporations incessantly sufficient cited nearly as good long-term investments?**

A4: Certainly! Companies like Alphabet (Google),Amazon,and Microsoft are incessantly acknowledged for their long-term development potential due to their innovation and market dominance. Additionally, corporations like Tesla and Shopify are notable gamers in their respective industries, showcasing sturdy development trajectories. However, it is vital to conduct thorough analysis and contemplate your funding horizon and danger tolerance earlier than committing.

—

**Q5: What position does macroeconomic stability play in the expansion of shares?**

A5: Macroeconomic stability is a big issue influencing long-term inventory development. Factors corresponding to rates of interest, inflation, and financial development charges can influence investor sentiment and enterprise efficiency. A steady financial surroundings encourages client spending and company investments, which might lead to sustained development for corporations. Investors ought to keep knowledgeable about financial indicators that may have an effect on their portfolio.—

**Q6: How usually ought to traders evaluation their long-term inventory investments?**

A6: While long-term traders do not want to monitor their shares day by day, it is prudent to evaluation their investments commonly—sometimes on an annual foundation. This permits traders to consider firm efficiency, business adjustments, and general portfolio alignment with their funding objectives. If a big change happens, whether or not optimistic or destructive, it’d warrant a reassessment of the funding.

—

**Q7: What is the perfect technique for managing danger whereas investing in development shares?**

A7: Diversification is a vital technique for managing danger. By spreading investments throughout numerous sectors and asset lessons, traders can scale back the influence of volatility in any single funding. Additionally,contemplate using stop-loss orders to defend towards vital downturns and staying knowledgeable about market developments to modify your technique as mandatory. Long-term development investing requires a stability between danger and reward.

—

**Q8: Is it ever too late to make investments in shares for long-term development?**

A8: It’s by no means too late to begin investing, though the timing can have an effect on your returns. The energy of compound development means that even late entries can profit from long-term holding methods. The secret’s to focus on strong, essentially sound shares and to commit to a method that aligns together with your monetary objectives. The earlier you begin, the extra time you give your investments to develop, however beginning anytime can nonetheless yield helpful outcomes.

To Wrap It Up

As we draw the curtain on our exploration of the perfect shares for long-term development, it is clear that the trail to funding success is paved with cautious analysis, persistence, and a strategic mindset.While no funding comes with out danger, choosing the proper corporations—these with strong fundamentals, progressive potential, and a dedication to sustainability—can place you favorably for future positive factors.

Remember, the perfect investments are sometimes those who align together with your private values and monetary objectives. As you embark on this journey, maintain in thoughts the significance of diversification and common re-evaluation of your portfolio. Emerging developments,market shifts,and particular person firm performances can all affect your investments,making it important to keep knowledgeable and agile.

Ultimately, long-term development is not only in regards to the shares you choose immediately however the imaginative and prescient you preserve for the long run. Whether you are a seasoned investor or simply beginning, strategy the market with curiosity and a willingness to study. The panorama is ever-changing,however with diligence and foresight,you may navigate it efficiently. Here’s to a way forward for knowledgeable funding decisions and sustained development!