As the digital panorama continues to evolve, the world of real estate funding is present process a transformative shift. With the appearance of superior know-how and revolutionary platforms, aspiring buyers now have extra alternatives than ever to enter the bustling real estate market. By the 12 months 2025, online platforms have refined their choices, offering seamless entry to numerous funding choices that cater to each seasoned buyers and novices alike. In this article, we’ll discover the best online platforms for investing in real estate in 2025, inspecting their distinctive options, advantages, and the methods in which they’re reshaping the funding panorama. Whether you are seeking to diversify your portfolio, earn passive revenue, or just dip your toes into real estate, these platforms are paving the manner for a brand new technology of funding alternatives. Join us as we navigate the thrilling realm of online real estate investing and uncover the instruments that may positively show you how to obtain your monetary targets.

Emerging Trends in Online Real Estate Investment Platforms for 2025

As we method 2025, online real estate funding platforms proceed to evolve, leveraging cutting-edge know-how and user-centric designs to draw a wider viewers of buyers. One of essentially the most notable tendencies is the mixing of **blockchain know-how** for improved transparency and safety.By using sensible contracts, these platforms can streamline the shopping for and promoting course of, permitting for real-time transactions whereas minimizing the chance of fraud. Additionally,**AI-driven analytics** have gotten more and more prevalent,providing buyers customized insights based mostly on market tendencies,particular person preferences,and danger profiles,thereby fostering extra knowledgeable decision-making.

Moreover, the idea of fractional possession is gaining momentum, permitting buyers to take part in high-value real estate initiatives with smaller capital outlays. this democratization of real estate investments is attracting millennials and youthful generations who are eager on diversifying their portfolios with out overwhelming monetary commitments. platforms are additionally focusing on **sustainable investments**, selling properties that meet eco-friendly requirements and enchantment to socially aware buyers.Key options defining these platforms embrace:

- User-friendly interfaces for seamless navigation

- Educational assets to empower novice buyers

- Community engagement by way of boards and webinars

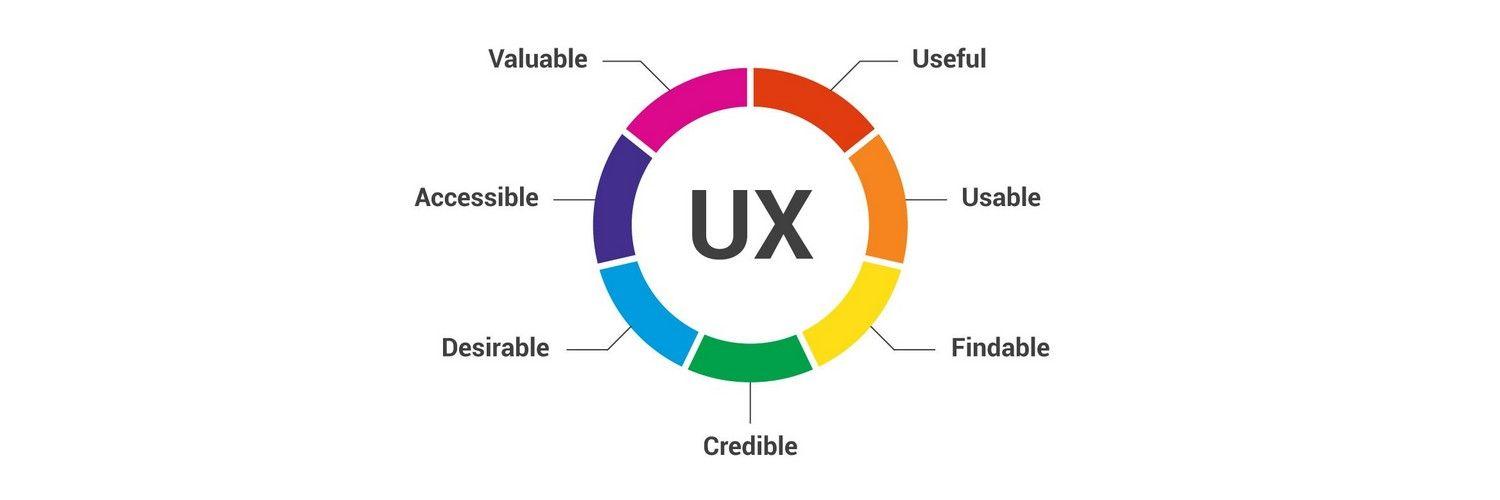

Comparative Analysis of User Experience and Accessibility

When evaluating online platforms for real estate funding, each consumer expertise and accessibility play essential roles in figuring out the effectiveness and satisfaction customers derive from these companies. A platform that prioritizes **intuitive navigation** and **aesthetic design** can considerably improve the consumer journey, retaining buyers engaged and knowledgeable. options such as customized dashboards, easy-to-use filtering instruments, and full cell accessibility enable customers to effortlessly assess their choices, handle their portfolios, and keep up to date on market tendencies from any system. the power to entry instructional assets or interactive design instruments additional enriches the expertise, empowering each novice and seasoned buyers to make knowledgeable choices.

from an accessibility viewpoint, platforms should be sure that they cater to a various viewers, together with people with disabilities.This means implementing **display reader compatibility**,**keyboard navigation choices**,and **captioning for video content material**. A dedication to a **color-blind pleasant** palette also can enhance usability for visually impaired buyers.Below is a desk outlining key accessibility options discovered in main funding platforms:

| Platform | Screen Reader Support | keyboard Navigation | Color Blind Friendly |

|---|---|---|---|

| RealtyMogul | Yes | Yes | Yes |

| Fundrise | sure | No | No |

| Roofstock | Yes | Yes | Yes |

| Cadre | No | Yes | Yes |

Top Recommended Platforms for Diverse Investment Strategies

When trying to diversify your funding methods, selecting the best platform is essential. Here are some **high platforms** that stand out in the real estate investing panorama for 2025:

- Fundrise - this platform permits people to take a position in real estate initiatives with as little as $500, making it accessible for small buyers. the concentrate on eREITs gives a combination of residential and industrial properties, ultimate for diversifying a portfolio.

- Roofstock – Focused on single-family rental properties,Roofstock provides a market the place you can purchase,promote,or make investments in rental properties,permitting for each passive revenue and progress alternatives.

- PeerStreet – This revolutionary platform permits buyers to fund real estate loans. It gives transparency and management, with a low minimal funding threshold, enabling a wider vary of buyers to take part in real estate financing.

- RealtyMogul – Catering to accredited buyers, RealtyMogul provides an array of business real estate investments, together with workplace and industrial properties, paving the way in which for extra strategic asset allocation.

To show you how to make an knowledgeable selection, think about the next comparability of key options:

| Platform | Minimum Investment | Type of Properties | Investment Type |

|---|---|---|---|

| Fundrise | $500 | Residential & Commercial | eREITs |

| Roofstock | $20,000 | Single-Family Rentals | Direct Ownership |

| PeerStreet | $1,000 | Various | Real Estate loans |

| RealtyMogul | $5,000 | Commercial | Equity & Debt |

Navigating dangers and Maximizing Returns in Digital Real Estate investing

in the ever-evolving panorama of digital real estate investing, understanding how to navigate dangers whereas aiming for appreciable returns is essential. Investors are more and more drawn to online platforms that supply the potential for diversification and accessibility. These platforms enable people to take a position in various kinds of real estate with no need vital capital. Key elements to contemplate embrace:

- Market Trends: Staying up to date with native and nationwide real estate tendencies can positively assist establish profitable alternatives.

- Platform Security: Ensuring that the platform provides sturdy safety measures to guard your investments and private info.

- Fees Structure: Analyzing the charges related to transactions and administration on every platform can have an effect on total returns.

- Investment Types: Understanding totally different funding choices such as crowdfunding, REITs, or direct property funding permits for tailor-made methods.

Moreover,leveraging technology-driven analytics can present insights that improve decision-making. Modern platforms typically embrace user-friendly interfaces and analytical instruments for efficiency monitoring. A comparative overview of some notable platforms reveals their strengths:

| Platform Name | Investment Type | Minimum Investment | Fees |

|---|---|---|---|

| Fundrise | REITs & Crowdfunding | $500 | 1% Annual Fee |

| Roofstock | Single-Family Homes | $5,000 | Variable Closing Costs |

| RealtyMogul | Crowdfunding | $1,000 | 1% + Performance Fees |

Q&A

**Q&A: Best Online Platforms for Investing in Real Estate in 2025**

**Q1: What are the important thing advantages of investing in real estate online?**

**A1:** Investing in real estate online opens a world of alternatives, making it accessible to people who could not have the capital to buy properties outright. Online platforms usually supply fractional possession, permitting buyers to purchase a portion of a property.Additionally, online investing can present decrease charges, transparency in transactions, and the comfort of managing investments from the consolation of your own home.

**Q2: What ought to I look for when selecting an online real estate funding platform?**

**A2:** When choosing a platform, think about elements such as consumer expertise, the variety of funding choices, charges, and the extent of buyer assist provided.Look for platforms which have sturdy transparency concerning potential returns, dangers, and the administration group behind the investments. It’s additionally sensible to overview any accessible instructional assets that might show you how to higher perceive real estate investing.

**Q3: Which online platforms are gaining traction in 2025?**

**A3:** As we enterprise into 2025, a number of platforms have proven nice promise. Notable mentions embrace Fundrise, RealtyMogul, and Roofstock for residential properties. For industrial real estate fans, platforms like CrowdStreet and EquityA number of have develop into more and more standard.Each of those platforms has distinctive options, permitting buyers to tailor their portfolios based mostly on danger and return preferences.

**This autumn: How does crowdfunding change the real estate funding recreation?**

**A4:** Crowdfunding democratizes real estate investing by enabling many people to pool their assets to take a position in properties that have been as soon as solely accessible to prosperous buyers. This mannequin not solely lowers the barrier to entry but additionally promotes neighborhood involvement,permitting buyers to align with initiatives that resonate with their values. Essentially, crowdfunding transforms the notion of real estate from a solitary enterprise right into a collective journey.

**Q5: Are there dangers related to online real estate investing?**

**A5:** Yes, like all investments, online real estate investing comes with its dangers. Market fluctuations, property administration points, or modifications in native economies can influence returns. Additionally, as these platforms are sometimes much less regulated than typical real estate investing, it is very important for buyers to carry out due diligence, perceive the particular dangers of every funding, and be ready for the long-term nature of real estate.

**Q6: how can I decide if online real estate investing is correct for me?**

**A6:** Assessing whether or not online real estate investing fits you entails contemplating your funding targets, danger tolerance, and time horizon. If you search regular,passive revenue and are snug with a long-term dedication,it’d be a becoming selection. moreover,when you worth diversification with no need to handle properties actively,online platforms present a wonderful avenue to discover.

**Q7: What’s the way forward for online real estate investing?**

**A7:** The future seems radiant as know-how continues to evolve. We can anticipate enhanced consumer interfaces, improved transparency by way of blockchain know-how, and the mixing of synthetic intelligence that analyzes market tendencies.Moreover, as youthful buyers develop into extra accustomed to digital transactions, the sector is extremely more likely to broaden, providing revolutionary funding options that cater to each particular person and institutional buyers alike.

**Q8: How can a newbie begin investing in real estate online?**

**A8:** For novices, beginning with small funding quantities and familiarizing your self with totally different platforms is vital. Many online platforms have instructional assets or user-friendly guides that will help you perceive the fundamentals of real estate funding. Create a finances and outline your funding targets earlier than diving in, and think about looking for recommendation from seasoned buyers to navigate this thrilling panorama.

Closing Remarks

as we step into 2025, the panorama of real estate investing continues to evolve, providing a wealth of alternatives for each seasoned buyers and newcomers alike. The platforms highlighted in this text symbolize a mix of innovation, accessibility, and strategic perception that may positively show you how to navigate this dynamic market.Whether you’re drawn by the attract of crowdfunding, the transparency of REITs, or the comfort of digital real estate transactions, there’s a platform to suit your funding type and targets.

Remember, as you embark on this journey, that thorough analysis and due diligence are your best allies. The digital realm of real estate investing not solely amplifies your potential for wealth-building but additionally democratizes entry to a market as soon as reserved for the few. So, equip your self with data, keep knowledgeable about rising tendencies, and select the platform that resonates together with your imaginative and prescient. Here’s to your success in making knowledgeable funding choices and harnessing the facility of real estate in this thrilling new period!