As we step into 2025, the world of private finance is present process a outstanding transformation, pushed by innovation and know-how. With our lives changing into more and more digital,managing savings and investments has by no means been extra streamlined. Enter the brand new wave of financial apps designed to cater to each financial want—from budgeting and savings to funding monitoring and wealth constructing. In this text, we’ll discover the best financial apps that are reshaping how people strategy their cash in 2025. Whether you’re a seasoned investor trying to optimize your portfolio or somebody simply beginning their savings journey, these instruments are right here to simplify your financial life, empower your decision-making, and finally make it easier to safe a brighter financial future.Join us as we delve into the options, advantages, and standout capabilities of those modern apps, making certain that you simply’re well-equipped to benefit from your cash in the yr forward.

important Features to look for in Financial Management Apps

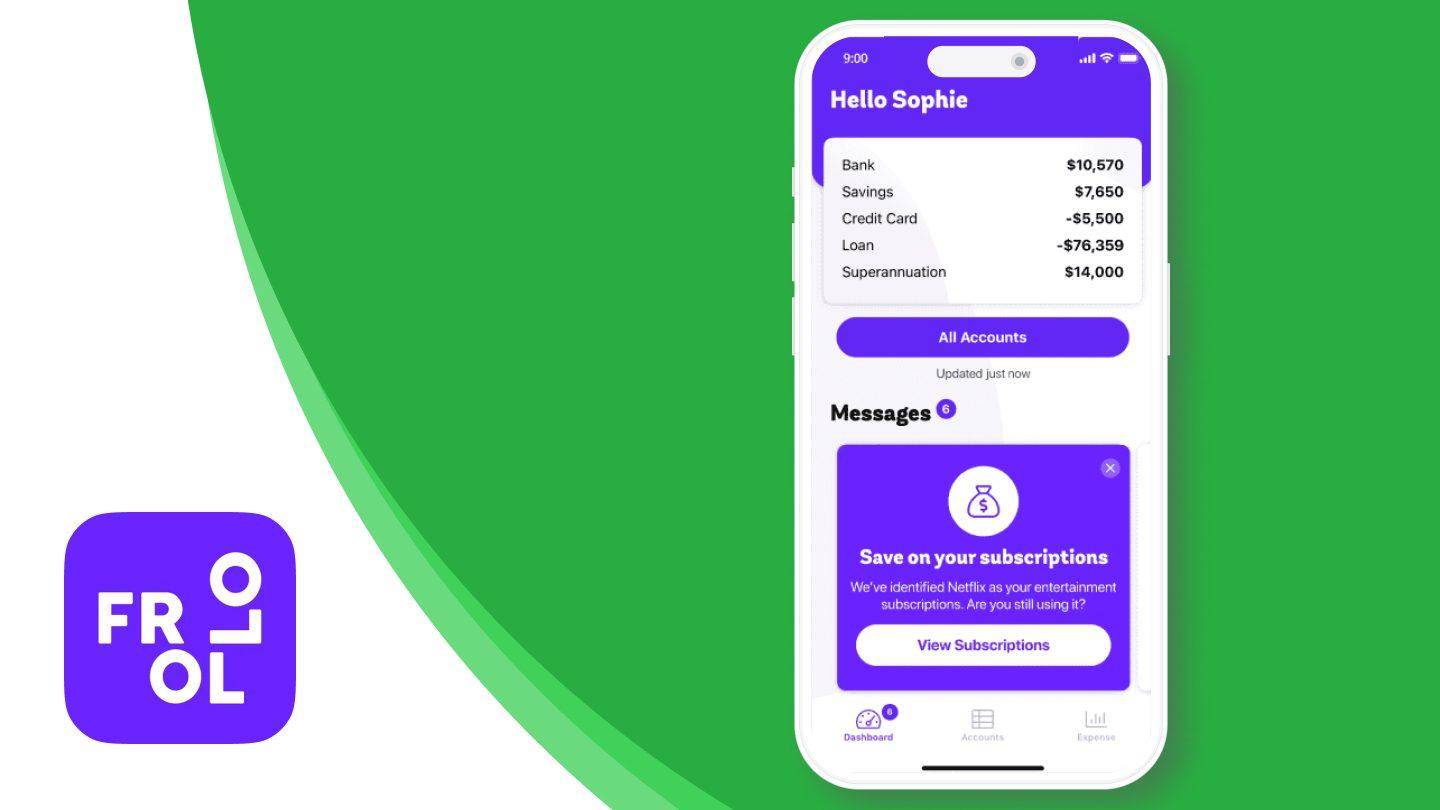

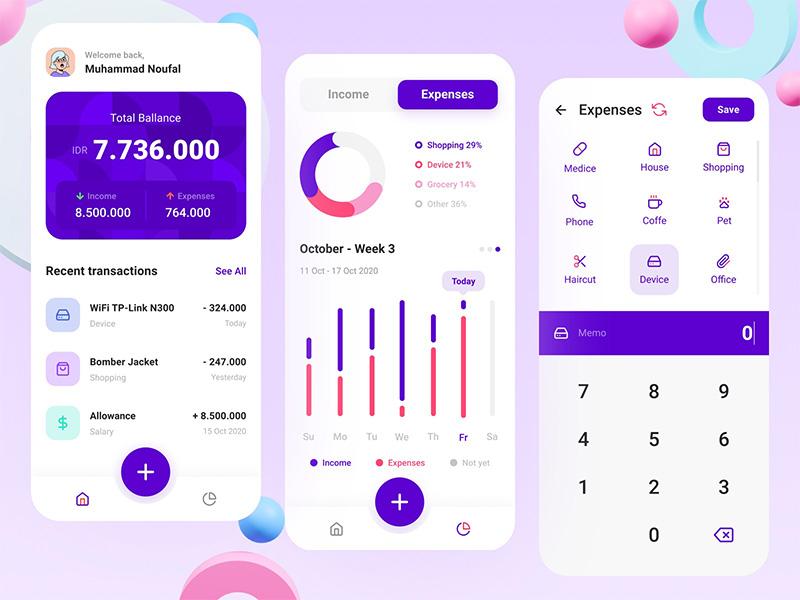

When looking for the proper financial administration app, customers ought to prioritize options that improve usability and present complete insights into their financial well being. **User-amiable interfaces** are essential, permitting people of all tech-savviness ranges to navigate effortlessly. Additionally, **automated budgeting instruments** can simplify managing bills, serving to customers adhere to their financial objectives with out fixed guide enter. Another important ingredient is **real-time transaction monitoring**, which permits customers to remain up to date with their spending patterns and savings. Moreover, contemplate apps that provide **bank-grade security measures**, making certain delicate financial information stays protected against unauthorized entry.

In addition to fundamental functionalities, apps that present customized insights could make a big distinction in managing funds successfully. **Goal-setting options** allow customers to set and monitor savings or funding goals, preserving financial aspirations in clear sight. integration with exterior financial accounts via **API connections** promotes a holistic view of 1’s funds, empowering customers to make knowledgeable choices. Furthermore, apps that provide **academic assets** or neighborhood engagement options can foster financial literacy, offering customers with beneficial information and assist in their financial journey.

In-Depth Reviews of Leading Savings and Investment Applications

As customers more and more prioritize financial well being, a wide range of main functions have emerged to assist customers successfully handle their savings and investments. These apps mix cutting-edge know-how with user-friendly interfaces, empowering customers to take cost of their financial futures.Some standout contenders embody:

- Acorns: A micro-investing app that rounds up your purchases to the closest greenback and invests the spare change, excellent for inexperienced persons.

- Betterment: An all-in-one funding platform that provides customized financial recommendation and automated portfolio administration.

- YNAB (You Need A Budget): Focuses on proactive budgeting strategies to assist customers allocate their cash successfully in the direction of savings and investments.

Additionally, the combination of social options and gamification in these functions has enhanced the funding expertise. Users can now share their financial journeys and milestones with buddies, fostering a way of neighborhood and accountability. Consider the next apps which have efficiently applied these partaking functionalities:

| App Name | Key Features | Best For |

|---|---|---|

| Robinhood | Commission-free trades, crypto buying and selling | Young buyers trying for quick access |

| Public | Social investing, neighborhood insights | Collaborative buyers |

| Wealthfront | Automated investing, tax-loss harvesting | Long-term buyers wishing for simplicity |

Maximizing Your Returns with Smart Investment Strategies

In immediately’s fast-paced financial panorama, using know-how can significantly improve your funding outcomes. With the rise of financial apps particularly designed for managing savings and investments, you may take management of your financial future extra effectively than ever. These apps regularly sufficient provide options resembling customized funding portfolios,real-time market insights,and automated savings instruments that make it easier to keep on observe with out the necessity for fixed monitoring. by leveraging the facility of information analytics,customers can optimize their methods based mostly on historical tendencies and predictive analytics,permitting for smarter allocation of assets.

To benefit from these superior instruments,contemplate integrating the next options into your funding strategy:

- Goal-Based Planning: Set clear financial objectives and let apps assist observe your progress.

- Robo-Advisors: Automate your funding technique based mostly on your threat tolerance.

- Expense Tracking: Keep a detailed eye in your spending to reinforce savings.

| App Name | Main Feature | Best For |

|---|---|---|

| Wealthfront | Automated Investment | Long-Term Growth |

| Acorns | Round-Up Savings | New Investors |

| Personal capital | wealth Management | Holistic financial Overview |

Tips for Seamless Integration of Financial Apps into Your Daily Routine

Integrating financial functions into your each day life is usually a sport changer for managing savings and investments. To begin, **select the appropriate apps** that align with your financial objectives and way of life. Here are some methods to make sure a seamless transition:

- **set particular objectives** for what you need to obtain with every app, whether or not it’s budgeting, monitoring investments, or monitoring savings.

- **Schedule common check-ins** to assessment your financial state and app efficiency, ideally matching this with one other routine exercise like morning espresso.

- **Customize notifications** to remain knowledgeable with out changing into overwhelmed; this may help in preserving your funds high of thoughts.

Furthermore, it is important to **combine these instruments into present processes**. For exmaple, linking your banking accounts can streamline transactions and improve accuracy in monitoring your spending.Consider these sensible ideas:

- **Automate transfers** to savings or funding accounts immediately via the app to create a “pay yourself first” routine.

- **Leverage insights and alerts** from the apps to optimize your spending patterns and reinforce optimistic financial behaviors.

- **Participate in neighborhood boards** associated to those apps for further ideas and assist from fellow customers.

Q&A

**Q&A: Best Financial Apps for Managing Savings and Investments in 2025**

**Q: what makes 2025 a pivotal yr for financial apps?**

A: As know-how continues to evolve, 2025 sees a surge in the combination of synthetic intelligence and machine studying in financial apps. This has allowed customers to obtain customized financial recommendation, maximize their savings potential, and handle investments seamlessly from their cell gadgets. The emphasis on user-friendly interfaces and enhanced safety measures has additionally set the stage for a brand new period of financial administration.**Q: Which financial apps stand out for managing savings in 2025?**

A: Several apps have garnered consideration for their modern options. “SaveSmart” combines gamification with conventional saving strategies, permitting customers to set objectives and earn rewards for assembly them. “PennyPlan” gives automated savings by rounding up purchases and allocating the spare become devoted saving accounts. Meanwhile, “NestEgg” prioritizes community-driven savings, the place buddies can inspire one another with shared objectives.

**Q: What funding apps are gaining reputation this yr?**

A: In 2025, “InvestWise” and “RoboFunds” have emerged as frontrunners in the funding app panorama. “investwise” makes use of superior algorithms to curate a customized portfolio based mostly on particular person threat tolerance and financial objectives. “RoboFunds,” however, gives lower-cost, automated investing with a clear payment construction, interesting notably to first-time buyers trying to construct their portfolios with out breaking the financial institution.

**Q: Are there any apps that successfully mix each savings and investments?**

A: Absolutely! “WealthNest” is an all-in-one platform that permits customers to save lots of whereas additionally investing their funds concurrently.The app analyzes customers’ spending habits and suggests optimum allocations for each savings accounts and funding alternatives based mostly on market tendencies.Its holistic view helps customers stability instant financial wants with long-term progress.

**Q: What key options ought to customers look for in a financial app?**

A: when selecting a financial app, customers ought to contemplate a number of important options. Look for sturdy safety measures, user-friendly design, and the power to sync with financial institution accounts. Customization choices for particular person financial objectives are essential, as is entry to dependable buyer assist. Additionally, academic assets throughout the app can positively assist customers make better-informed choices relating to their funds.**Q: How do financial apps in 2025 strategy person privateness and safety?**

A: Privacy and safety stay high priorities for financial apps in 2025.Many of the main platforms incorporate multi-factor authentication, biometric login choices, and end-to-end encryption to safeguard person information. Transparency about information utilization and easy person agreements additionally assist give customers peace of thoughts that their financial particulars is safe.

**Q: Can you advocate any budget-friendly financial apps for customers hesitant about prices?**

A: Certainly! In 2025, a number of financial apps provide free plans or minimal charges. “BudgetBuddy” offers complete finances monitoring and savings ideas at no cost. “InvestMate” gives commission-free investing choices, making it accessible for customers with restricted financial assets. When deciding on an app, all the time discover the pricing mannequin to find out if there are any hidden charges earlier than committing.

**Q: how does the neighborhood facet play into the effectivity of financial apps immediately?**

A: Community options are changing into more and more important in financial apps, fostering a sense of assist and accountability. Many apps now permit customers to share their objectives, observe progress collectively, and have interaction in challenges with buddies. This social ingredient encourages customers to remain motivated and engaged with their financial journeys, which has confirmed useful in constructing long-lasting savings habits and funding practices.

**Q: What ought to customers hold in thoughts when utilizing financial apps in 2025?**

A: Users ought to keep in mind that whereas financial apps can provide beneficial insights and instruments, the duty of managing private funds finally lies with them. It’s necessary to remain knowledgeable, conduct common check-ups on investments and savings objectives, and strategy financial choices with warning. Embracing a proactive mindset is essential for maximizing the advantages of those trendy financial companions.

Final Thoughts

As we navigate the ever-evolving panorama of private finance in 2025,the appropriate instruments could make all of the distinction in reaching your financial objectives. From glossy budgeting interfaces to sturdy funding trackers, the best financial apps empower customers to save lots of smarter and make investments correctly. As you contemplate which app suits your distinctive wants, keep in mind that the journey to financial wellness is as a lot about schooling and technique as it’s about know-how.

By leveraging these modern instruments, you may take management of your financial future, turning aspirations into actuality. Whether you’re simply beginning your savings journey or trying to optimize an present portfolio, these apps function your steadfast companions, serving to you observe progress and keep motivated alongside the way in which.

In a world the place each greenback counts, let these digital allies information you in the direction of extra knowledgeable choices, sustainable progress, and finally, financial freedom. Here’s to harnessing the facility of know-how to pave the way in which for a brighter,safer financial tomorrow. Happy saving and investing!